Will office rental demand in Vietnam drop as hybrid working gets trendy?

Will office rental demand in Vietnam drop as hybrid working gets trendy?

In the next few years, Gen Z will be the main trend-setter of the workplace of the future.

Vietnam's office rental demand continues to look positive largely in the coming time, thanks to growth in office-based employment, weaker adoption of flexible working practices, and the enduring vital role of offices in Vietnam.

The forecast was recently released by Cushman & Wakefield, the commercial real estate services firm in Vietnam, given that the office market in the first half of 2022 still showed a continuous recovery and growth, despite many changes in the behavior and habits of office users in the past two years.

CMC Creative Space - new office project in Ho Chi Minh City. Photo: CMC Group |

The latest Q2 report from Cushman & Wakefield noted that the future workplace will be an ecosystem that offers many options for employees both in terms of workspace types, working time, and amenities around the office.

Trang Bui, General Manager of Cushman & Wakefield, said: “Demand for Grade A & B office rises due to the growing number of newly registered businesses and expansion needs from foreign investors. Most companies expect a quality space equipped with an expansive view of the city center, one that can enhance the brand, attract clients and talents alike.”

However, the past five years have seen no new supply of Grade A office space, and the number of projects to be launched in Ho Chi Minh City in the next two years is scarce with only a few such as The Hallmark (handover expected at end of this year) and The Sun Tower (handover expected in 2023).

“The supply shortage situation is also recorded in the mid-range segment as there are only a few buildings completed and ready to be leased this quarter: CMC Creative Space (District 7), Pearl 5 (District 3),” she added.

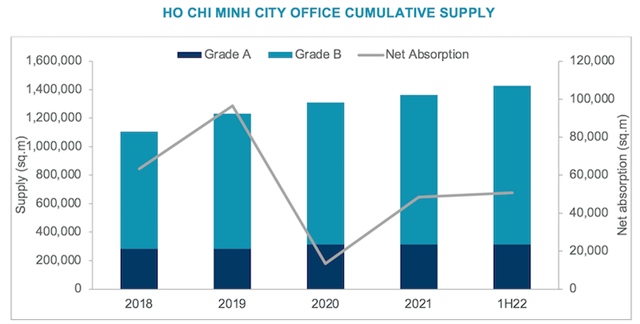

New projects included Cobi Tower I&II in District 7, completed and added 27,000 sq.m of new supply into the market. The South submarket has emerged as a major office cluster with the continuous completion of Grade B buildings in Phu My Hung NUA. Total Ho Chi Minh City office supply Grade A & B reached 315,000 sq.m and 1,113,000 sq.m, combinedly up 4.7% y-o-y.

Source: Cushman & Wakefield |

The Q2 report saw office rental prices remain relatively stable, even at final units in prime location buildings. Grade A and Grade B average rent was US$59.9 per sq.m per month and $34 per sq.m per month, up 1.9% YoY and 1.2% YoY, respectively.

For rental demand, Cushman & Wakefield recorded office re-location and expansion accounting for 70% and 26% respectively of total leasing transactions in the first six months of 2022. Transactions mainly came from industries such as Software development (21.67%), Logistics (18,61%), and E-commerce/Fintech (13%). According to its records, tenants with relocation needs tend to target the center such as District 1 and its fringe area.

Major challenges of the hybrid model

In another report by Cushman & Wakefield titled “Asia Pacific Office of the Future Revisited”, the majority of office workers in the Asia Pacific including Vietnam want to be more flexible in the way they work.

Hybrid working is not a new concept, but it was relatively foreign to the mass before the virus hit. A hybrid office is similar to a flexible space, which provides employees with a variety of different places and ways to work and can accommodate the flexible schedule of all teams. Hybrid spaces offer hot desks, co-working areas, and focused booths for any type of tasks and work preferences that employees can have. This is quite different from traditional offices with fixed workstations and cubicles.

However, the culture of presenteeism, limited housing space, and an unstable network connection are some of the factors slowing down the trend of hybrid working in the country.

Trang emphasized the major challenges of the hybrid model: “Despite the surprising levels of productivity, many occupiers noted that increased remote work has created a perceived cost in long-term productivity, corporate culture, innovation, and creativity. The office is still an essential tool in retaining and recruiting talent and communicates a company’s brand and culture. Amenities are now key differentiators, evolving into spaces for employees to work, socialize and connect with colleagues.”

For older generations, the new hybrid model might take quite some time to stick. The traditional office was designed to be functional, with team members sitting next to each other, and physical attendance is counted towards performance.

However, the uptake of hybrid working in the Asia Pacific is likely to accelerate as Generation Z - those born between 1997 and 2012 - accounts for a larger percentage of the working-age population. By 2030, Generation Z will number nearly one billion people and account for more than one-third of the labor force. Generation Z is the first generation of digital natives. They expect a seamless connection between the physical and the digital, which is also what allows hybrid working to flourish.