Removing barriers to boost real estate development in Vietnam

Removing barriers to boost real estate development in Vietnam

The Ministry of Construction will submit to the National Assembly for approval of regulations and laws related to real estate.

Procedure-related issues are one of the major barriers to the development of the real estate market in Vietnam.

This was pointed out at a conference themed "Developing a Safe, Healthy and Sustainable Real Estate Market" on July 14 in Hanoi.

Sunshine City project in Tay Ho District in Hanoi. Photo: Sunshine Group |

According to Minister of Construction Nguyen Thanh Nghi, in order to implement a housing or urbanization project, investors have to overcome more than 30 different procedures provided in different laws and regulations of competent authorities.

Over the past years, the system of policies and laws governing the real estate sector has been basically completed and synchronized, including the Law on Real Estate Business 2014, Land Law, Housing Law, and the Law on Residential Housing, the Law on Investment, and the Law on Bidding.

In 2021 and early 2022, the Vietnamese Government issued a series of decrees on the implementation of related laws to remove difficulties and obstacles, simplify procedures, and facilitate real estate investment and business activities, he added.

However, the rather onerous legal framework is somewhat confusing for local authorities, leading to inconsistency in handling legal procedures for housing and urbanization projects, the construction minister noted.

Thanh Nghi said his ministry will propose some amendments to the Law on Land, the Law on Residential Housing, the Law on Real Estate Business, and the Law on Bidding to improve regulations covering real estate business activities, as well as enhance the efficiency of real estate market management.

At the event, Le Hoang Chau, Chairman of the Ho Chi Minh City Real Estate Association (HoREA), also said that it is necessary to conduct a comprehensive revision of relevant regulations and laws to create a transparent and fair business investment environment, as well as improve the efficiency of law enforcement.

Prime Minister Pham Minh Chinh addresses his speech at the conference. Photo: VGP |

Presiding over the conference on July 14, Prime Minister Pham Minh Chinh stated that the real estate market plays a very important role in maintaining macroeconomic stability, controlling inflation, and promoting growth.

The conference was aimed at assessing the current situation and pointing out the limitations and inadequacies of the real estate market, put forth domestic and international experiences based on which solutions would be proposed to improve the real estate industry and related fields to ensure the stable and healthy development of the real estate market, he underlined.

At the event, Minister of Construction Nguyen Thanh Nghi said, over the years, the real estate market has made an important contribution to the economy with a share of about 11% of GDP in recent years.

In the first six months of 2022, only a few new housing projects kicked off. During the period, 13 projects with 6,000 apartments have been completed and the total floor area is about 300,000 m2. The figures are not commensurate with the demand, Nghi added.

No new supply recorded in Hanoi

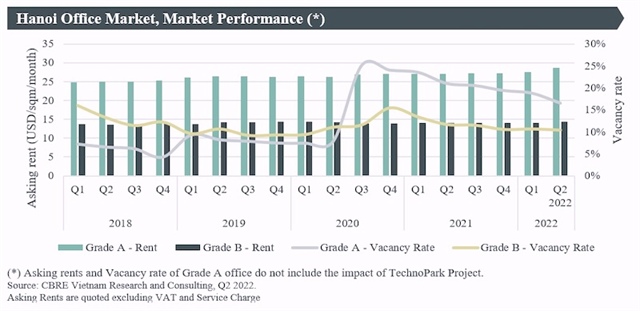

According to the Vietnam Real Estate Market Research Report of the second quarter of 2022 by Colliers, in the office segment, no new supply has been recorded in Hanoi, and most office buildings had stable occupancy of over 75%. It is expected that the capital city will have more new office buildings in Grade A & B in the next 1-2 years.

In terms of demand, CBRE, the commercial real estate services, and investment firm saw, in the second quarter of 2022, office expansion and relocation demand continued to contribute to the majority of its transactions in Hanoi, accounting for more than 82% of the total. Strong leasing momentum would ensure a stable absorption rate.

IT/Tech and Banking/Finance/Insurance continued to dominate the market, accounting for 37% of all transactions in Hanoi and kept expanding their leased premises.

CBRE also recorded several transactions from local real estate firms establishing new offices in Hanoi. Another demand driver during the review period is co-working space, with transactions accounting for 17% of the total volume in the first half of 2022.

Source: CBRE Vietnam Research and Consulting, Q2/2022 |

In the industrial real estate segment, Colliers witnessed robust activities in Q2/2022, with 90% occupancy rate in Hanoi, Ho Chi Minh City, and the beach city Danang. Average rental price hiked the most in Ho Chi Minh City, increasing by 26% y-o-y, followed by Danang with 13% increment as compared to the same period last year and 10% in Hanoi.

In terms of supply and demand, northern provinces adjacent to Hanoi such as Bac Ninh, Hung Yen, Haiphong, and Hai Duong were attracting large-scale investors.

Chi Vu, Industrial Services Manager of Colliers (Vietnam) said: “Consistent with the global trend post-pandemic, the boom of e-commerce and logistics has been driving growth in Vietnam industrial real estate. Besides, Vietnam’s strategy for the development of digital industry by 2025 are paving the way for the growth of real estate for information technology zone in the coming time.”

In the second quarter, new supplies of condominium in three of Vietnam’s major markets came from high-end and luxury segment. Demand outstrips supply in all segments in Hanoi, luring interests from foreign investors. With the appearance of luxury projects in the last quarter, primary price increased 10% y-o-y and is expected to continue with the infrastructure development and the participation of Southern developers.