Vietnam's stock market on foreign funds’ radar amid possible upgrade to EM status: HSBC

Vietnam's stock market on foreign funds’ radar amid possible upgrade to EM status: HSBC

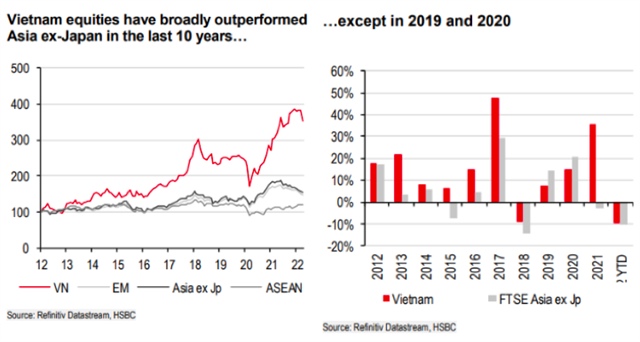

Vietnam has outperformed major regional indices, making the market nearly quadrupled in size compared with the start of 2012 and the trading exceeding $1 billion a day.

In its latest report, HSBC has stated that many funds already have Vietnam’s stock market on their radar with excitement about the country’s potential inclusion in the emerging market (EM) index.

Vietnam's stock market expected a bright future. Photo: The Hanoi Times |

If the inclusion weight for Vietnam in EM Asia is 2%, inflows would be US$8-9 billion. That is 1.4x the current allocation by foreign funds and close to eight days of trading, HSBC noted in its latest study.

The FTSE added Vietnam to a watch list in September 2018 for possible reclassification to secondary EM status, due in September 2022. The market is yet to make it onto MSCI’s watch list, but if required reforms are implemented, it might meet the necessary criteria ahead of May 2023, it added.

On a roll

According to the report, Vietnam has outperformed all the major regional indices in the last 10 years and the market has nearly quadrupled in size since the start of 2012, with trading recently exceeding $1 billion a day.

|

In 2021, the capitalization of the stock market surpassed $350 billion, exceeding 120% of the country’s GDP. The Vietnam market has the second-highest liquidity in ASEAN, now surpassing even Singapore and Indonesia.

Meanwhile, Vietnam also has a home-grown economic engine, driving a shift in the composition of the local stock market away from Consumer Staples towards Financials and Real Estate, encouraging locals, who now dominate trading, to invest, it added.

Earnings have remained buoyant in Vietnam, with a CAGR of 10% in the last ten years. Vietnam is among the very few markets globally that saw positive earnings growth in 2020 when Covid-19 hit. As the pandemic eased, earnings growth was as high as 35% y-o-y in 2021.

So far this year, however, the Vietnamese market is down 10%, although that still means it is marginally a relative outperformer, stated the HSBC.

Big changes in the stock market

As people found employment in new factories dotted around the nation, they got a steady salary, higher wages, and a bank account, credit card, or mortgage. That’s why the stock market saw a remarkable change in its make-up; while Consumer companies dominated in 2015, these days it is Financials and Real Estate that make up the largest portion of this market.

The stock market in Vietnam was in the past highly concentrated around a few large stocks. But those days are over too. In 2013, the top-5 accounted for 52% of the total market cap; in 2022, it stands at 25%. The top-10 market caps now account for less than 20% of overall turnover.

But contrary to what many believe, the investors that pushed this market higher were not foreign, but local. The stock market has seen a surge in retail investors and the number of retail accounts more than doubled between December 2018 and 2021.

These local investors account for as much as 87% of all trading in the market, while foreigners make up the remaining 13%. As these retail investors came into the market, foreign investors withdrew.

However, in the past few weeks, foreign investors have started to dip their toes into this market again, stated the HSBC.

Factors for growth

According to the report, foreign direct investments have been a key driver of Vietnam’s economic growth: 3/4 of exports are from sectors with strong foreign investment. In the past few years, Vietnam has made it easier to set up a business and has simplified land registration and loan processes. This, along with a low cost of production, has made it the place to set up a new factory.

|

In recent years, the country has seen multiple inward relocations of manufacturing facilities to get access to cheaper labor and land, and hence stands out in terms of grabbing the market share of global exports.

Meanwhile, the population is young and the country enjoys an adult literacy rate of more than 95%. On education scores – such as in the chart below – Vietnam does better than other ASEAN markets and even China.

Infrastructure spending and investments in logistics have supported a flurry of activity in industrial, commercial, and residential real estate.

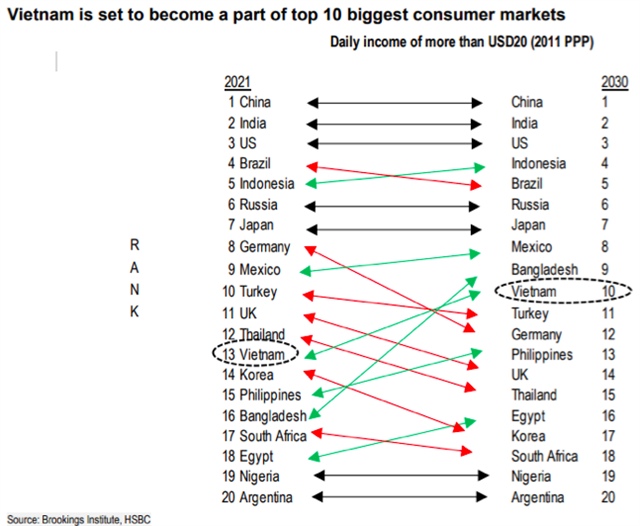

But the Vietnamese consumption story is still underappreciated. The percentage of the country’s population that is categorized as upper-middle-class is set to quadruple, to 20% by 2030 (as per Brookings Institute). That’s an acceleration from the rise in capita income of 10% since 2005.

“Indeed, Vietnam is set to become the tenth largest global consumer market in 2030,” noted the HSBC.

These customers want to be online, while retailers and banks are busy enhancing their digital capabilities and offering digital banking programs and tools. It also means that Vietnam is one of the most attractive markets in the region for financial inclusion and the fintech space.