Vietnam has big fintech dreams but needs adequate legal framework

Vietnam has big fintech dreams but needs adequate legal framework

The world has been witnessing the rapid development of digital banking over the past few years, a development expected to greatly boost fintech business in Vietnam.

Banks going digital

According to a report by McKinsey, in 2020 and 2021, the number of Vietnamese regularly using digital banking services increased 82 percent, with 43 and 21 percent of users interested in transfers and payment services, respectively.

Last year, Vietnam's financial market witnessed the birth of many digital banks. Ninety-three percent of banks recently surveyed by the Vietnam Report said they were investing in technological innovation and developing digital sales channels, and 80 percent said they were digitalizing core operations and attracting high technology and information technology workers.

|

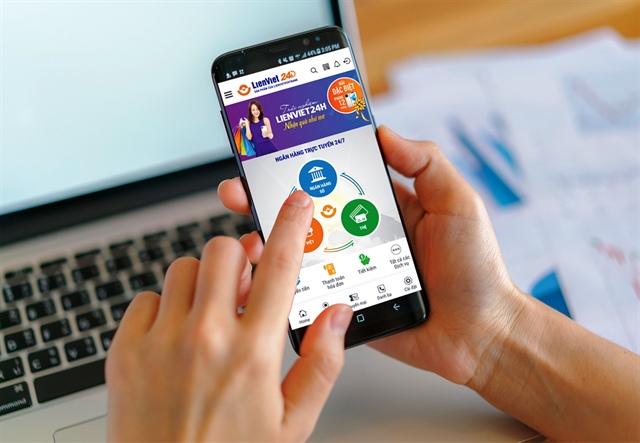

Many banks have designed applications with smart and user-friendly interfaces, launched charge-free card and internet banking services with eKYC (electronic identification), all associated with different attractive promotions and gifts to improve competitiveness and lure more customers.

According to Tu Tien Phat, General Director of the Asian Development Bank (ACB), digital banking not only includes common website and application-based banking services for individual customers, but also modern financial utilities that allow users to open cards and/or a saving account online, withdraw cash at ATMs and transfer money through QR code scanning, buy insurance, and more.

Do Quang Vinh, Deputy General Director of the Saigon-Hanoi Commercial Joint Stock Bank (SHB) said customer needs are changing and becoming more diverse and sophisticated requiring banks to accommodate these changing needs and wishes. They should implement practical digital transformation, he added.

Fintech opportunities

Fintech companies have two options – they can use the B2C (business to customer) model to provide financial services directly to customers, competing or cooperating with banks; or follow the B2B (business to business) model to provide service solutions for banks and financial institutions.

Fintech is expected to boom this year in Vietnam, but being a new field in Vietnam it still lacks an adequate legal framework and expert management authorities. The country currently only has initial regulations on payment intermediaries and eKYC.

Fintech businesses have opportunities to develop in Vietnam |

Vietnam is ready to become one of the most competitive fintech markets in Southeast Asia, with more than 80 percent of its population using mobile phones but far fewer accessing banking services. The country’s non-cash payment promotion policy, e-government development and a target of having 80 percent of adults with a bank account by 2025 will greatly contribute to the overall development of this field.

While financial experts believe that 2022 will see a fintech boom in Vietnam, proper regulations and legal frameworks are expected to be a key driving force for the development of this sector in the country.

According to data from Insignia Ventures Partners, as of January 2022, 46 intermediary payment service provider licenses were granted to electronic wallet, gateway, currency conversion, clearing, payment support and transfer service providers. Fintech can be applied in different fields, apart from finance, banking and insurance. About 200 Fintech companies are operating in different fields in Vietnam, including payment intermediaries, peer-to-peer lending, blockchain technology, investment, and credit rating.