Shares bounce back, realty and construction the highlight

Shares bounce back, realty and construction the highlight

Shares bounced back on Thursday after a brief decline in the previous session with realty and construction stocks being the highlight of the market.

On the Ho Chi Minh Stock Exchange, the VN-Index increased 0.4 per cent to close at 1,528.57 points.

Meanwhile, the HNX-Index on the Ha Noi Stock Exchange grew stronger by 0.94 per cent to end at 484.89 points.

Liquidity continued to climb with nearly 1.3 billion shares worth a total VND39.4 trillion (US$1.7 billion) being traded in the two markets, up 8 per cent in volume and 7 per cent in value compared to Wednesday’s levels.

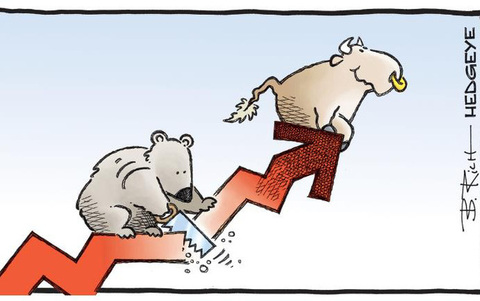

“Profit-taking pressure is currently weighing on the market in general, so the VN-Index may correct. However, there was a short-term retest state and it is expected that the VN-Index will be supported quickly when it drops back to the area of 1,510 points,” Phuong Nguyen, a stock analyst at Viet Dragon Securities Co, wrote in a daily report.

However, divergence has returned and was the highlight of the market.

Real estate and construction shares were the biggest gainers and supporters of the market on Thursday.

Vingroup (VIC) and Vinhomes (VHM) slowed down slightly in the afternoon session but still contributed largely to the VN-Index’s gain. VIC jumped 4.5 per cent and VMH increased 1.6 per cent.

Many small- and mid-cap stocks also climbed strongly such as Dat Xanh Group (DXG), FLC Group (FLC), An Duong Thao Dien JSC (HA), Industrial Urban Development JSC No 2 (D2D), Khai Hoan Land Real Estate (KHG), NBB Investment (NBB) and Sai Gon Thuong Tin Real Estate (SCR) which increased between 5 per cent and 7 per cent.

The construction group had a bigger influence on the Ha Noi Stock Exchange. Big gainers were mostly small-caps such as Thanh Dat Investment Development (DTD), Licogi 14 (L14), Thang Long JSC (TTL) and Vinaconex 25 (VCC) with growth of between 9-10 per cent.

Phuong predicted the market generally sticks to an uptrend but advised investors should slow down and restructure their portfolios reasonably for the time being.