Banking sector to lower lending rates in 2022: Deputy Prime Minister

Banking sector to lower lending rates in 2022: Deputy Prime Minister

The banking sector is expected to tighten credit into risky fields, including real estate and securities.

The banking sector should continue to lower lending rates, especially in priority fields, which serve as a viable solution to support businesses, people and aid economic recovery.

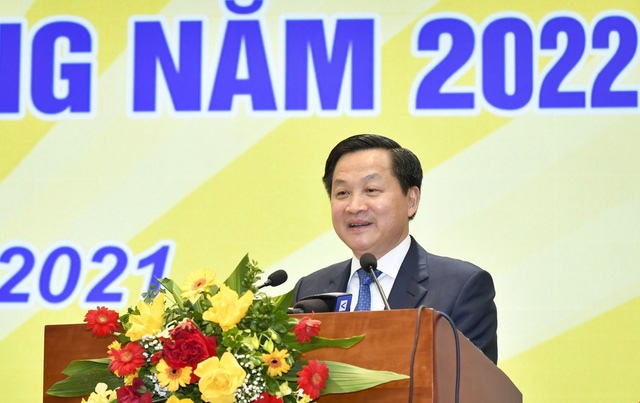

Deputy Prime Minister Le Minh Khai. Source: VGP |

Deputy Prime Minister Le Minh Khai gave his remarks at a year-end meeting held by the State Bank of Vietnam (SBV) on December 29.

“It is imperative for the banking sector to improve credit quality and channel the capital flows into business/production activities or promote infrastructure development projects with high spillover effects,” Khai said.

In this regard, Khai called for further tightening of credit into risky fields, including real estate, securities, and the issuance of corporate bonds from credit institutions.

Overview of the meeting. |

He requested the SBV to draft a clear plan on restructuring credit institutions and resolving bad debts in the 2021-2025 period. The main objectives would be to help banks with high potential to reach the regional level and solidify weak banks, especially those under strict supervision.

Despite the severe Covid-19 impacts, Vietnam’s credit growth in 2021 is estimated to expand by 13%, while the SBV has instructed banks to keep a low-interest-rate environment to aid businesses/people affected by the pandemic.

So far, banks have foregone nearly VND34 trillion (US$1.5 billion) in profit by lowering and waiving interest rates for customers; restructured debt payment schedule for total outstanding loans of VND600 trillion ($26.3 billion); provided loans with lower lending rates worth VND7,200 trillion ($315.8 billion).

Inflation target set around 4%

At the meeting, SBV Vice Governor Dao Minh Tu noted in 2022, the SBV would continue to manage the monetary policy in a flexible manner to ensure inflation stays around 4%.

“The target is necessary to stabilize macro-economic conditions and support growth,” Tu added, noting the credit growth is forecast to expand by 14%, slightly higher than this year.

Given the high risks of bad debts rising to over 7% on the Covid-19 impacts, Tu said the SBV is committed to addressing the issue by enhancing supervision activities at credit institutions, especially in lending in high-risk fields, so as to keep the bad debt ratio at the safe limit of less than 3%.

Another priority for the SBV in 2022 pointed out by Tu is to push for digitalization in the banking sector and promote non-cash payment.

From a macro perspective, the SBV is responsible for finalizing a legal framework to facilitate digital transformation in the banking sector, which serves as the foundation for new business models and banking products to thrive.

Banks are now offering interest rates of 3-4% per annum for loans of less than six months, 3.7-5% for 6-12 months, and 4.2-6.5% for over 12 months. On the contrary, lending rates for short-term loans are 5-7% per annum and 9-11% for loans of over 12 months.

In 2020, the SBV cut its interest rate caps four times, the moves which have encouraged commercial banks to provide cheaper loans.

Accordingly, the refinancing interest rate is lowered from 4.5% per annum to 4%, rediscount rate from 3% to 2.5%, overnight interest rate from 5.5% to 5%, and interest rate via OMO from 3% to 2.5%.

The SBV also lowered the interest rate ceiling to 4% annually from 4.25% for deposits with maturities of one month to less than six months.

|

By the end of 2021, credit institutions in Hanoi have restructured debt payment schedules for 68,700 customers with outstanding loans of VND76.5 trillion; waived and lowered interest rates for 317,000 customers for VND575 trillion; provided new loans with a preferential rate of VND2,355 trillion for 186,000 customers since January 23. |