Vietnamese exports relieved from tariffs burden

Vietnamese exports relieved from tariffs burden

The heavy burden on tariffs for Vietnamese exports to the United States of America has finally been removed, following a meeting of the US Secretary of the Treasury (UST) Ms. Janet Yellen and the Governor of the State Bank of Vietnam (SBV), Ms. Nguyen Thi Hong.

Illustrative photo.

|

Relief for Vietnam

Both UST and SBV have published a joint agreement on the UST website, which reads: “The US will not impose rigid tariffs on Vietnam, and the SBV will allow the value of the Vietnamese Dong (VND) to increase in line with Vietnam's strong economic foundation.”

The US-Vietnam joint statement clearly implies that Vietnam's policymakers are under considerable pressure to allow the VND to appreciate. This was reinforced by the statement by US Trade Representative (USTR), Ms. Katherine Tai, that the USTR, in collaboration with the UST, will monitor Vietnam's implementation of commitments related to the valuation of its currency.

In our opinion, it is almost certain that the value of VND increases steadily by 2% to 3% per year, as huge capital continues to flow into the country and the SBV no longer continues non-neutral interventions, that reduced the value of VND in recent years.

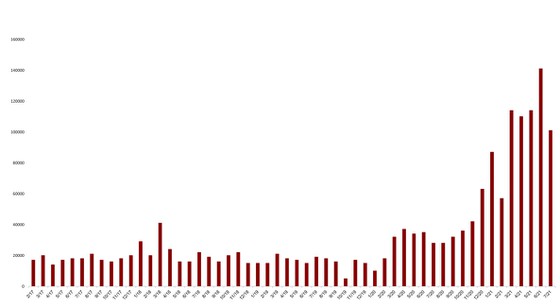

Vietnam's exports to the US increased by 26% in 2020, and again increased by 45% over the same period last year, bringing Vietnam's trade surplus with the US to USD 38 bn in the first half of 2021. These figures are in context of Vietnam's trade surplus with the US, equivalent to 20% of GDP, compared to China's trade surplus of 2% GDP with the US. One of the UST criteria to be considered a currency manipulator is when there is a trade surplus of USD 20 bn with the US during the last one-year period.

At the end of 2020, the UST branded Vietnam a currency manipulator, accusing Vietnam of intentionally reducing the value of VND to 10% below fair value. With this allegation, UST opened an investigation under Section 301 into Vietnam's trade practices. These actions raised concerns in Vietnam, as the USA has used Article 301 as a reason to impose tariffs of upto 25% on nearly half of China's exports to the United States of America.

However, we are not too concerned about investigation under Section 301, which issued a report in October 2020 titled “There is no risk that the United States will impose draconian tariffs”, as well as posting several articles in domestic business magazines on this topic. Until the beginning of August 2021, many investors continued to believe that tariffs were a big risk, due to Vietnam's trade surplus with the US skyrocketing.

All round victory

According to our estimates, foreign capital equivalent to 10% GDP has flowed into Vietnam in 2020, including Foreign Direct Investment (FDI) inflow of 7% GDP. Capital inflow into Vietnam, together with a current account surplus of 4.5% GDP, have brought Vietnam's balance of payments (BoP) surplus to 7% GDP in 2020, with expected BoP surplus of 5% in 2021. This explains why the value of the Vietnamese dong has remained so solid this year, even increasing slightly in recent weeks, despite the worsening Covid-19 situation in all of Vietnam.

With this new agreement, the US government has stopped threatening to impose tariffs on Vietnam, despite Vietnam's high trade surplus, or the fact that Vietnam continues to exceed the UST criteria to be considered a currency manipulator. This development demonstrates the strong desire of US policymakers to maintain friendly relations with Vietnam for geopolitical reasons, showing that the US is willing to give up and compromise in order to promote stronger ties between both countries.

In addition to the absence of tariffs that will encourage FDI inflow, this agreement will greatly benefit Vietnam in the long term, by stimulating capital flow from foreign financial investors, as these investors prioritize stable countries. They also focus where domestic currencies appreciate; encourage domestic companies to improve their competitiveness; and improve the living standards of consumers by promoting further development of Vietnam's domestic economy. The “Asian Tigers” thrived on export manufacturing, but most depended on export-oriented manufacturing for too long, resulting in their currency valuation being significantly lower for many years.

Change in US strategy

When a country intentionally devalues its currency to support exports, the quality of life of its citizens suffers. When the currency is undervalued, it creates inefficiencies, distorts dynamics and ultimately is detrimental for most domestic firms. Conversely, an appreciation of the VND will help the country escape the middle-income trap, by encouraging innovation as local companies will not be able to rely on a cheap exchange rate to compete. However, as factory wages in Vietnam are two-thirds lower than in China, they will retain a competitive edge for many years to come.

The current non-interventionist attitude of planners of US policy towards Vietnam's trade surplus stems from the escalation of US-China tensions, to which policymakers are responding by increasing US engagement in Southeast Asia. This engagement strategy was promoted in “Longer Telegram: Towards a New America’s China Strategy,” a report published by the prestigious Atlantic Council think tank in early 2021. The Biden administration's Asia strategy director, Mr. Kurt Campbell, reiterated the strategy a few weeks ago when he said the US needs to step up its game in Southeast Asia. This opens up great opportunities for Vietnam to benefit from US economic support, as the US is becomes more receptive to Vietnamese exports. This is also the strategy the US used for supporting Japan and South Korea during the cold war.