Vietnam's stock market accessibility set to improve with new changes: MSCI

Vietnam's stock market accessibility set to improve with new changes: MSCI

The local stock market is expected to be upgraded to the emerging status by 2022.

A number of laws that came into effect at the start of 2021 in Vietnam are expected to set the legal basis for further market developments.

World’s major largest index provider Morgan Stanley Capital International (MSCI) gave the view in its 2021 Global Market Accessibility Review, which covers market accessibility assessments for 83 markets.

Investor at a securities company. Photo: Cong Hung

|

According to the MSCI, the restructuring of the two Vietnamese exchanges [Ho Chi Minh City Stock Exchange and Hanoi Stock Exchange] into a single Vietnam Stock Exchange (VSE), the establishment of the Vietnam Securities Depository and Clearance Corporation (VSDC), or Non-voting Depository Receipts may potentially improve market accessibility once these policies are implemented.

The MSCI also pointed out the fact that the Ho Chi Minh City Stock Exchange (HOSE) in Vietnam has been impacted by capacity limitations in its trading system since 2021.

This has resulted in trade execution difficulties on days with relatively high trading volumes, in turn prompting exchange and the regulators to work on short-term and long-term solutions to address this issue.

“MSCI will continue to monitor these developments closely,” it noted.

Expectation to be upgraded to emerging market by 2022

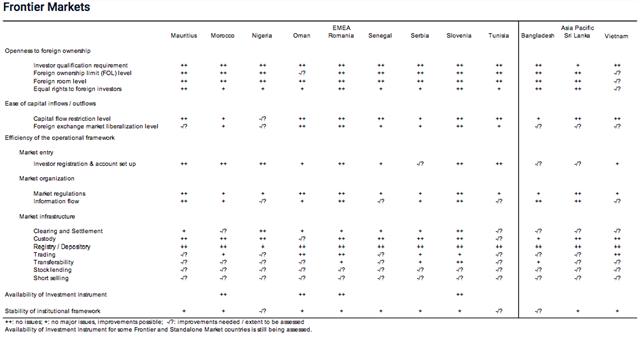

MSCI's assessment on frontier markets. Source: MSCI

|

While pointing out to positive improvements of the market, the MSCI noted there have been no significant development that could result in any rating changes.

The MSCI referred to a number of fields that should be addressed, ranging from foreign ownership limit subject to certain conditional and sensitive sectors, no offshore currency market and constraints on onshore currency market, lack of stock market information in English, or off-exchange transactions and in-kind transfers requiring prior approval from the State Securities Commission of Vietnam.

The rating agency is scheduled to announced the annual market classification of stock markets globally, including Vietnam, on June 25.

Bao Viet Securities Company (BVSC) in a note said while market upgrade would be an irreversible trend and in line with Vietnam’s efforts in global economic integration, it is unlikely that the market could be upgraded in this review.

Sharing the same view, SSI Securities Corporation (SSI) said the chance is higher for the stock market to realize its goal of becoming an emerging one by the next review in 2022.