Steel price ripple effect felt across domestic businesses

Steel price ripple effect felt across domestic businesses

Global steel prices continue to be in sharp focus, with recent record-breaking highs pushing contractors to the wall as well as raising questions on whether steelmakers have been colluding to hike rates, which have shot up drastically since last year.

Analysts say the record highs of steel prices should fall somewhat moving into the second half of the year

|

Last Thursday the benchmark iron ore price plunged as much as 9.5 per cent in China as market participants paused after a huge rally that had sent prices to new highs in the days preceding it.

Iron ore had surged to a record $237.57 per tonne in New York the previous day as strong Chinese demand continued to outpace supply, but analysts remained unconvinced that the run would gather any more speed. Other steel-making ingredients also then dropped in price by the end of last week.

BMO Capital Markets analyst David Gagliano said prices are likely to remain well above historical averages for the remainder of 2021 and into next year.

“Our base case, which sees prices moderate in the second half of 2021, is becoming increasingly conservative given that most domestic US capacity is now restarted or running all-out, import growth remains limited, finished steel inventories remain low, lead times remain extended, and global raw materials and finished steel prices continue to move higher,” Gagliano wrote.

The record price levels have been backed up by a continued supply squeeze, with major iron ore producers reporting seasonally lower output in Q1 of 2021, and rising anxiety over the continued pandemic crisis in India, which could harm the country’s exports of the metal.

“These factors, along with a recovery in ex-China demand, are expected to drive the global seaborne trade balance into a deeper deficit in 2021, with annual prices forecast to average $153 per tonne,” said Ronnie Cecil, principal analyst for metals and mining research at S&P Global Market Intelligence. Cecil noted that a seasonal rise in Brazilian exports is also likely to lower prices in the second half of the year.

Moody’s Investors Service also remarked that the eye-watering iron ore prices would likely recede, but still remain strong amid persistent supply constraints.

Production imbalance

Besides blaming high global prices of iron ore on current logistics issues and high demand, India has this year been investigating whether steel companies have plotted to increase prices of several products after their steel prices surged 40-45 per cent from June 2020 levels.

Due to similar concerns in Vietnam after prices ballooned by 40 per cent since last year, the Ministry of Construction this month requested municipal and provincial people’s committees and relevant agencies to regularly monitor and closely follow market developments to promptly update and adjust the price of construction materials to avoid being affected by the phenomenon of speculation.

The Vietnam Association of Construction Contractors (VACC) also asked the Government Office to investigate the price hike and find out if steelmakers were cooperating with each other to push up prices.

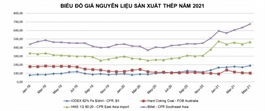

However, the Ministry of Industry and Trade (MoIT) said it was a baseless assumption, explaining that local steel prices depended on prices of raw materials needed for production, most of which are imported. The prices of raw materials have risen because of long shipping times as the supply chain is hindered by the ongoing pandemic.

Nghiem Xuan Da, chairman of the Vietnam Steel Association (VSA), explained that the sudden spike in steel prices recently is mainly due to the imbalance in production, supply-demand reciprocity, and dependence on imported input materials such as scrap steel and ores. Along with that, the pandemic has disrupted global supply chains, causing delays in delivery times – another reason for the sharp increase in steel prices.

Major corporate steel consumers have been shocked by the increase in rates, particularly those in auto manufacturing, real estate, and construction.

“Every time we receive a notice of steel quotation adjustments we have a sharp intake of breath because we have price fluctuations of 5-10 per cent in the contracts and no-one predicted steel price increases of 40 per cent,” said Hoang Minh Manh, a contractor at Hoang Chi Viet Nam Company, adding that his company accepted the losses to keep faith and reputation while attempting to find profit from other business lines.

Vice chairman of the Vietnam Association of Building Materials Le Van Toi said that construction investment currently accounts for about 65-70 per cent of public investments. Increase in steel prices will raise the total investment as well as contractor and construction contracts, disrupting medium-term capital plans.

According to one forecast, material prices may increase medium-term capital by 3-7 per cent. For one project this number may be insignificant, but huge when including all current projects, causing budget deficits and affecting fiscal policy.

“The management of package contracts signed before the time of price increase of construction steel will face difficulties, especially contracts with fixed unit prices, package contracts with low contingency costs, and the disadvantaged parties are the contractors,” Toi said.

Nguyen Quoc Hiep, chairman of the VACC, said contractors have faced difficulties in the upsurge as most investors signed construction contracts with fixed prices that cannot be adjusted up.

Some VACC members are on the edge of bankruptcy and have been afflicted ever since steel prices began to rise more sharply in late 2020.

Among the largest contractors, Hoa Binh Construction Group and Coteccons saw a drop in profits thanks in part to hiked steel prices.

Conteccons’s first-quarter profit was the lowest since the Q2 of 2013 and gross profit margin was only 4.7 per cent. Meanwhile, the net revenue of Hoa Binh Construction Group dropped 34 per cent on-year.

Meanwhile, steelmakers have conversely reaped benefits. By the end of the first quarter, Hoa Phat Group recorded relatively positive business results. Revenues in the period totalled $843 million and profit after tax reached $100 million, respectively increasing 28 and 27 per cent as compared to the same period of 2019.

In April, Hoa Phat Group sold 869,000 tonnes of steel, increasing 65 per cent from the same period last year. Alone, finished construction steel sale was up 59 per cent from April 2020 to reach 428,000 tonnes. Last month the steel export volume was 73,000 tonnes, 3.5 times higher than the corresponding period last year.

Meanwhile, Hoa Sen Group said that its consolidated business results for March are estimated at $180 million of net revenues, up nearly 18 per cent on-year, leading to $20 million of profit after tax. It exported high-value batches of galvanised steel sheets during the initial months of the year to the United States, Mexico, Europe, and Southeast Asia with the local group’s export volume exceeding 120,000 tonnes per month.

Similarly, at the end of the first three months of the year, Me Lin Steel JSC recorded an after-tax profit increase of 41 times compared to the first quarter of 2020, reaching $674,000 thanks to high steel prices and reduction in financial expenses and sales.

Listed firm Ho Chi Minh Metal Corporation posted revenues of over $47.8 million, up over 40 per cent over the same period of 2020, while its profit after tax gained over 10 times compared to last year to $2.5 million, marking the highest quarterly profit since it was founded.

Seeking the answers

The government is drastically directing disbursement of public investments to ensure economic growth and social security. At a monthly meeting, Deputy Prime Minister Le Minh Khai asked the MoIT to push for increased domestic steel production towards stabilising prices.

On May 11 the MoIT issued Document No.2612/BCT-CN to the VSA and large steel manufacturers, proposing a range of solutions that include restricting the export of domestic steel products and other in-demand products.

According to data from the VSA, in terms of both output and steel exports in the first quarter of this year, there was a sharp increase compared to the same period last year. Specifically, steel production of all kinds reached 7.66 million tonnes, up 33.8 per cent, and steel exports of all kinds reached 1.63 million tonnes, up 59.5 per cent on year.

On May 1, China revived taxes on steel exports and cut tariffs for ferrous imports such as alloy, carbon, and cast iron in a bid to shore up domestic supply. Meanwhile, the Indian government has proposed to slash import duties on steel items further to provide relief to small- and medium-sized enterprises, which have been hit hard by the high cost of raw materials amidst the pandemic.

A representative of the VACC said that there should be a decree which can guide adjustments when material prices spike. For example, when the price of steel rise by over 20 per cent, the contractor could be allowed for adjustment under the guidance of state management agencies; and if the increase is lower than 20 per cent, the contractor must calculate in order to ensure production and business efficiency.