Elevated household debt remains big concern for Vietnam banking sector: HSBC

Elevated household debt remains big concern for Vietnam banking sector: HSBC

Elevated consumer leverage could drag down future consumer spending, especially as labor market conditions have been severely impacted by the pandemic.

Sharp rise in riskier consumer lending, along with elevated household debt, remains a big concern for Vietnam’s banking sector.

HSBC made the statement as it assesses the health of Vietnam’s banking sector by analyzing the balance sheets of the “Big 4” state-owned banks (Vietcombank, BIDV, Vietinbank and Agribank), accounting for half of total loans.

|

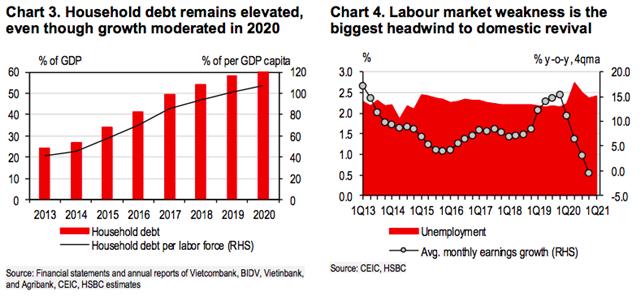

“Loans to households rose substantially from 28% of total “Big 4” loans in 2013 to 46% in 2020, which translated into rapid growth in household debt from 25% of GDP to 61% in the same period,” noted the HSBC’s report.

“Elevated consumer leverage could drag down future consumer spending, especially as labor market conditions have been severely impacted by the pandemic,” it added.

Although Vietnam’s economy is in a more robust shape than regional peers, its labor market weakness remains a concern for the recovery of domestic demand, HSBC added.

Banking procedures at a Vietcombank branch in Hanoi. Photo: Thanh Hai

|

“On the surface, unemployment metrics look decent, with the unemployment rate falling to 2.4% in the first quarter of 2021 from its peak of 2.7% in the second quarter of last year. However, employment was still around 950,000 below the pre-pandemic level, while wages fell for the first time in recent years,” said HSBC.

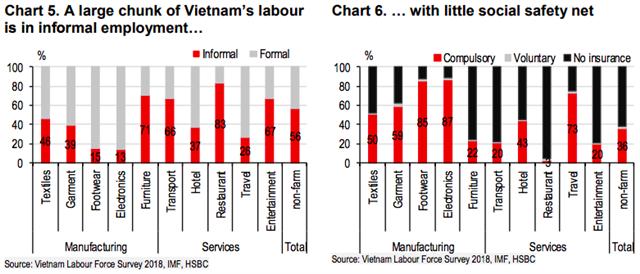

Moreover, a large chunk of Vietnam’s labor market is still concentrated in the informal sector, which may not be collected in formal employment statistics. This is particularly the case in sectors like furniture manufacturing, restaurant services and entertainment, where workers have very little social safety net.

|

“Thus, even Vietnam’s fiscal support is constrained by its elevated public debt-to-GDP, some targeted fiscal stimulus for vulnerable households and workers is still needed,” noted the report.

And even more urgently, the spending of support disbursements, such as cash transfers and tax deferrals for household businesses, needs to be accelerated, which would in turn support a rapid recovery in private consumption, it said.

Growing risks from bad debts

Along with household debt, the HSBC also mentioned risks from growing bad debts. “If we include other impaired loans, such as those sold to Vietnam Asset Management Company (VAMC), overall NPLs are estimated to rise from below 5% in 2019 to 7% in 2020.”

|

Although each bank has a different breakdown of loans by industry, manufacturing and wholesale/retail stand out, boding well for Vietnam’s prospects in industrial production.

Indeed, the authorities have been consistently calling for credit channeling into productive sectors, and credit to industry and trade still grew by over 10% year-on-year in 2020. That said, credit to riskier sectors like real estate has accelerated since December 2020, prompting the State Bank of Vietnam (SBV) to flag potential risks.

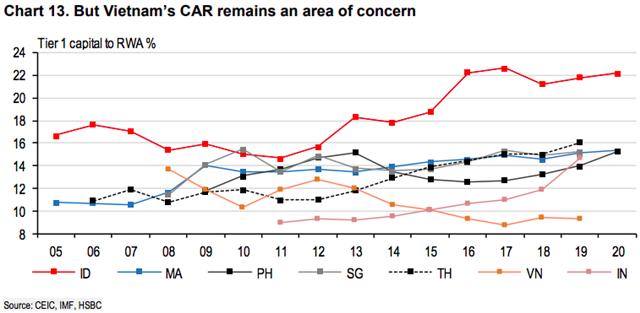

HSBC noted Vietnam lags behind regional peers as it is the only ASEAN country that has not fully met the Basel II minimum standard of 8%. In particular, capital adequacy ratios (CARs) remain low at some state-owned banks. Thus, Vietnam needs to progress its recapitalization plans and accelerate its adoption of Basel II requirements, which has been delayed from 2020 to early 2023, HSBC suggested.

“While its robust economic growth may prevent a sharp deterioration in the health of the banking sector, we believe it is time for the sector to restore reforms and build strong capital buffers against potential risks,” stated the HSBC.