Cash circulation necessary to stimulate economy

Cash circulation necessary to stimulate economy

The government had placed large sums of money into circulation to support the domestic economy during the ongoing Covid-19 pandemic.

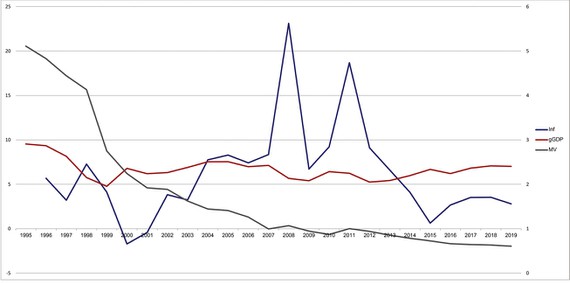

Fig. 1: Relationship between inflation, GDP growth, velocity of money. (Source: Author's synthesis)

|

However, this money seems to be stuck within the financial system, or is being poured into stocks and real estate, rather than into production. Drastic measures are now necessary to bring this cash flow back into the production sector.

Speed of money flow

In 2019 and 2020, the State Bank of Vietnam had lowered the interest rate three times in order to implement the monetary expansion policy and stimulate the economy. Looking at economic recovery in a post Covid-19 pandemic scenario, the Government has been implementing a combination of expansionary fiscal and monetary policies to boost GDP growth. However, besides the concept of the money supply, it is also important to consider the speed of money flow, which is another way to measure the health of the economy.

According to Milton Friedman's calculated theory M*V=P*Q, which guages money quantity, M is the quantity of money supply, V is the velocity of money, P measures price change of goods and services in an economy, Q is the volume of goods and services traded. The velocity of money is related to the frequency of monetary transactions in the economy. The high velocity of money is often a sign of a healthy economy, because money is exchanged for fast commodities, and the cash flows faster. Economists divide money into two categories. First, money primarily used by people and companies for transactions which is called "operating money", and second, money used to save and accumulate which is called "idle money". The more idle money there is in the economy, the slower the speed at which money is circulated.

Fig. 1 shows that the velocity of money in Vietnam has continuously dropped to a very low level over the last 20 years. There is concern if the current velocity of money is so low due to too much idle money in the economy. The decreasing velocity of money in Vietnam implies that the cash flow from hand to hand is very slow, reflecting a decline in transactions and consumption of businesses and households after 2011. Instead, most of the money can be used to pour into investment channels such as stocks, real estate or exist in the form of savings rather than production and consumption. This cash flow may be the source for the bubble caused recently in real estate and stocks.

Since the outbreak of the Covid-19 pandemic until the end of 2020, 95 documents have been issued to support businesses and people with four major policy packages, namely, VND 250,000 bn for credit support; VND 180,000 bn of tax-deferred support; VND 16,000 bn for 0% interest rate loans; VND 30,000 bn for fiscal packages and a series of other measures. This has been followed by the social security support package of VND 62,000 bn under Resolution 42/NQ-CP on measures to support people in difficulty due to the Covid-19 pandemic.

However, the velocity of money continued to decline during this phase, showing that the huge amount of money that seemed to have been trapped in the public financial system showed reluctance to be consumed by the people, and also slowed GDP growth which did not meet expectations. Disbursement conditions for manufacturing enterprises and services are quite strict, and the social security system can be considered as old, making effectiveness of support policies decrease significantly.

Solutions to stimulate growth

First, it is vital to increase the flow speed of money. To increase the flow speed of money and fasten the speed of spending on goods and services, there is need to increase the demand for goods and services, stimulate production, employment, increase income, and ultimately boost GDP. In society, low-income people are usually the group that spends money fastest on goods and services every time they have money at hand.

Therefore, the Government needs to strongly reform the social security policy, so that the money can be quickly delivered to the people, especially the disadvantaged and low-income groups. When money turns up, they will use more services, increase their purchasing power, stimulate production and more jobs are then created, wages also increase and in turn this creates a vortex to promote economic development.

Second, there is need to promote credit growth. The manufacturing sector is an important driver of economic growth. Therefore, the Government should have solutions to facilitate credit flow to businesses and households. Besides, tightening capital flow into real estate or investing in stocks to avoid deviation of investment cash flow causing asset bubbles, which are not conducive for socio-economic development. Banks can also lower their profit targets, and share them with producers and households with medium-term loan packages, with attractive and stable interest rates, helping them to stabilize production. When production is stable and employees have jobs, it becomes a fertile platform for banks to seek profits.

Third, it is essential to promote digital transformation via enterprises and state management agencies. It is wise to invest in digital transformation today to create future economic growth, save costs and improve operational efficiency. The digital transformation process will help businesses increase productivity, promote output growth in proportion to the increase in money supply, and will also help keep inflation at a stable level. Digital transformation can be the key to the production process, creating a turning point for the economy, helping the economy move away from stagnant forces, and gradually move closer to stable growth, without too much fiscal and monetary stimulus from the Government.