The IPO "blockbuster" DXS: Where does the power come from?

The IPO "blockbuster" DXS: Where does the power come from?

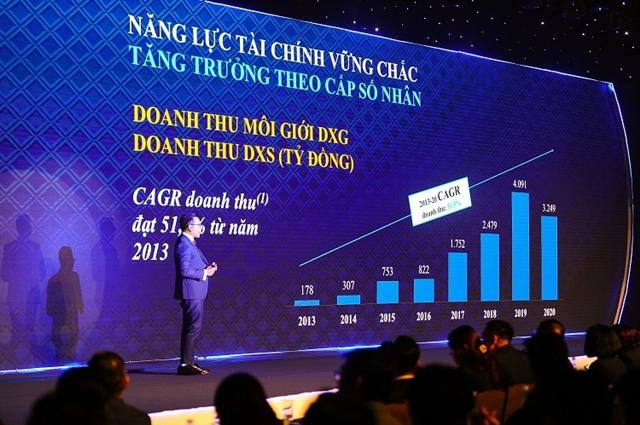

Without competitive leverages, it would be difficult for any company to survive in the brokerage industry where barriers to entry are getting lower. Professional brokers are "reshaping the industry” with many different directions, with Dat Xanh Services (DXS) taking the lead.

In recent years, companies in the real estate brokerage industry have been listed on the stock market to seek new development opportunities, such as CENLand or Hai Phat Invest, or recently DXS. Holding a leading share of the brokerage market across the country, DXS has its own charm with many differences.

The first thing to see is that DXS has a solid relationship with most investors in the market as it has the ability to participate in project development from the beginning, increasing the value of the project and bringing cash flows with a high rate of return for the company. Since 2003, the company has distributed more than 130,000 products from 500 projects of 200 investors.

Besides, thanks to the parent group which is the investor of many projects, DXS has a major source of “back-up” products and is ahead of the many professional brokers looking to transform into real estate developers for better profit prospects. Meanwhile, the brokerages companies of large-scale real estate developers are still mainly serving their internal ecosystem, without looking to promote the expansion of the whole market.

The IPO event of DXS in Ho Chi Minh City on March 29th drew in many real estate investors, financial companies, securities companies, and experts

|

In contrast, DXS is actively expanding relations with local developers across the country, where growth in the real estate sector is still very large, while some brokers only focus on certain large urban areas such as Ho Chi Minh City or Hanoi. Up to now, DXS has a nationwide distribution network with an overall market share of up to 29 per cent (nearly double that of its next competitor), according to Savills statistics.

A strong foundation in the primary market is considered an important stepping stone for DXS to transform into a “full-services” model in the future. Since 2019, DXS has been developing a secondary brokerage segment (resale brokerage), financial services, and real estate management.

“We want to develop DXS to follow a service ecosystem where customers can transact any real estate distributed by DXS,” DXS leaders shared at the company's IPO ceremony recently. “Whether working directly with investors or just buying and selling, all will be served by DXS. We will also offer many other related services such as financial services or insurance.”

The advantage of developing an ecosystem not only offers cross-selling benefits but also provides a steady stream of cash with a high rate of return. This is also a popular model in many countries around the world, where the revenue of the brokerage service company comes from many different services, not just home sales.

Investing in technologies to complete the eco-system

Many brokers announced large investments in technology and DXS is no exception. In the announcement of its capital use target after the IPO, DXS focuses heavily on the technology side.

Last year, a real estate financial services company and real estate brokerage technology platform were introduced by DXS. The O2O technology platform (Real Agents) not only helps property listing but also provides many other related features such as legal inspection, valuation, and rental management. This year, DXS hopes that trading steps will be automated and executed on the online platform.

The technology platform of DXS has grown tremendously in recent years

|

Technology will be the new standard for professionalism in the brokerage industry because it helps to expand the market and reduce costs. However, technology development is only one part of the story, setting up a database for the is even more important.

While startups are "burning” money to get customer data, DXS has a database of 7.5 million customers. In comparison, the databases of many mid-sized banks only cover about 3-5 million customers. Its ability to update data is another advantage of DXS because real estate transactions and associated services are executed continuously, helping the company expand its database and increase the system’s accuracy.

The database is also an important premise to develop other services of the DXS ecosystem. “All these services will be integrated into one platform, helping DXS become a comprehensive brokerage unit and optimise the high-margin service segments,” said DXS leaders.