IMF maintains Vietnam GDP growth forecast at 6.5% in 2021

IMF maintains Vietnam GDP growth forecast at 6.5% in 2021

Vietnam would be the second fastest growing economy in ASEAN.

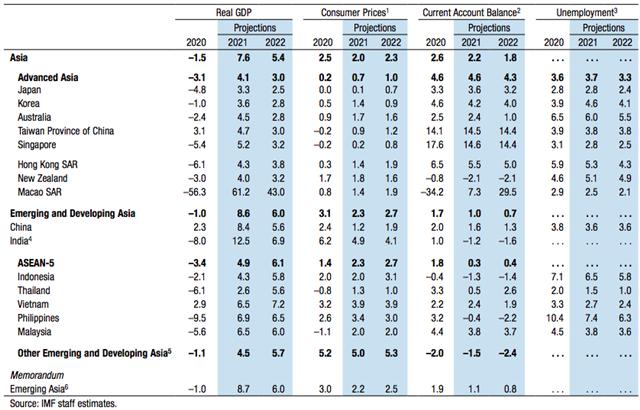

Vietnam’s GDP is set to expand 6.5% in 2021, higher than the global average of 6%, and then rebound to 7.2% next year, according to the International Monetary Fund (IMF) in its latest World Economic Outlook report.

Asian and Pacific Economies.

|

Such growth would put Vietnam as the second fastest growing economy among five major economies of ASEAN (Indonesia, Thailand, Vietnam, the Philippines and Malaysia) along with Malaysia, and behind the Philippines at 6.9%, revealed the report.

Meanwhile, the ASEAN-5 is set to average a growth rate of 4.9% in 2021 and 6.1% next year.

According to the IMF’s report, positive economic prospect is expected to put Vietnam’s unemployment rate down to 2.7% in 2021 from 3.3% of last year, which would then further decline to 2.4% in 2022.

For the global economy, the IMF expected the world’s growth to stay around 6%, 0.8 percentage point higher than its previous forecast last October, reflecting additional fiscal support in a few large economies and the anticipated vaccine-powered recovery in the second half of the year.

“Thanks to unprecedented policy response, the COVID-19 recession is likely to leave smaller scars than the 2008 global financial crisis,” stated the IMF in a statement.

“However, emerging market economies and low-income developing countries have been hit harder and are expected to suffer more significant medium-term losses,” it added.

IMF Managing Director Kristalina Georgieva at the virtual meeting

|

At the virtual 2021 Spring Meetings held on April 7, IMF Managing Director Kristalina Georgieva called for governments to collaborate and provide vaccines to everyone, saying ”faster progress in ending the health crisis could add almost US$9 trillion to global GDP by 2025—best value for public money in our times—but this window of opportunity is closing fast.”

Georgieva revealed the IMF would allocate funding of US$650 billion to help address the long-term global need for reserve assets and provide a substantial liquidity boost to all country members, especially the most vulnerable.