Great benefits for investors and shareholders from Phat Dat’s shares (PDR) in 2021

Great benefits for investors and shareholders from Phat Dat’s shares (PDR) in 2021

Respect for commitments to shareholders and investors and making its best attempts to fulfil commitments in all cooperative relations are one of the key business characteristics of Phat Dat (HSX: PDR).

The Astral City project by Phat Dat along National Road No.13 in Binh Duong city

|

At the 2021 annual general meeting of shareholders, Phat Dat approved the third dividend payment (the final dividend) of 2020 at the rate of 11.7 per cent in shares, resulting in a total of 3-time share dividends for 2020 at 28.7 per cent. This is a strong affirmation of the benefits the company offers from dividends for its shareholders and investors.

Dividends have been made regularly and continuously, bringing the total dividend ratio up to 53.7 per cent since 2019.

In 2020, Phat Dat made three share dividend payments to shareholders: 7 per cent, 10 per cent, and 11.7 per cent for the last payment expectedly made in the middle of the second quarter of 2021. Previously, tapping 2019’s profit, Phat Dat paid two dividends, including 12 per cent in cash and 13 per cent in shares.

Distributing 2020's profit by stock dividends enables outstanding benefits to shareholders and investors, showing the Board of Directors and Board of Management's great determination to promote the interests of the company's investors and shareholders.

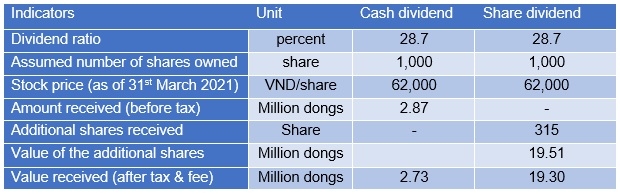

Comparison of the values of cash and stock dividends, assuming shareholders hold shares for a long term. Source: PDR

|

Thus, by way of share dividends, shareholders and investors will receive the following benefits:

First, compared to cash dividends, the total value of 2020’s share dividends (return on investment) would be over 7 times higher if the shareholder held shares during all three dividends to the end of May 2021 and 5.7 times higher if the shareholder sold shares right after the payment date. In this way, shareholders and investors can accumulate assets faster in the current context where the company made such strong growth and development.

As of April 6, 2021, Phat Dat's shares price were valued at VND67,800. According to SSI's assessments on investment and valuation, “SSI produces recommendations by applying RNAV [area navigation] method, and PDR’s RNAV is 4 per cent higher than the current share price. Presently, PDR is trading with 2021’s P/E and P/B of 12.4x and 3.8x, respectively.”

Simultaneously, PDR's share price has increased by 138 per cent compared to 2019 and is expected to continue to grow in the coming time, providing even greater benefits to investors and shareholders.

Second, the average time shareholders receive additional shares is only 1 month (compared to the market average of at least 2-3 months) thanks to the company's synchronous process to create favourable conditions crediting shares on investors’ accounts.

Finally, PDR’s liquidity on the market is considerably high, especially after PDR entered the VN30 basket.

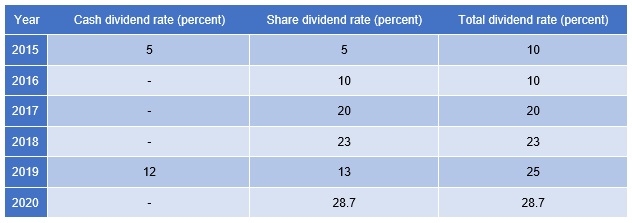

Dividend payments from 2015 to 2020. Source: PDR

|

In 2015-2020, Phat Dat achieved a high growth rate in terms of business results, sustainable financial structure, and improved profitability, resulting in the net revenue increasing by 8.8 times (a compound annual growth rate [CAGR] of 54 per cent) and in the after-tax profit of the parent company's shareholders increasing by 7.6 times (a CAGR of 50 per cent).

Therefore, the company possesses a stable cash flow to pay cash/share dividends to shareholders regularly at a rate of 20-30 per cent per year from the distribution of after-tax profit.

Thus, with the upcoming 11.7 per cent share dividend, PDR wishes to constantly increase benefits and surplus value for shareholders and investors in the future.