Coolcat investment platform swindles millions from thousands

Coolcat investment platform swindles millions from thousands

More than 1,800 people in HCMC say they have been cheated of millions of dollars by an bogus insurance investment platform.

Dozens of investors come to a HCMC police office to accuse Coolcat of cheating them of their money, April 23, 2021. Photo by VnExpress/Viet Anh.

|

Dozens of people gathered Friday in front of a HCMC police station on Tran Hung Dao Street in District 1. They filed 488 complaints accusing Coolcat, a self-claimed insurance investment platform, of cheating them of huge sums of money.

Mai Thanh, 41, said she represented over 1,800 investors who have been tricked by Coolcat, whose app and URL domains vanished overnight on April 16. Another group had already filed similar complaints with the police on April 19.

While the exact number is yet to be determined, investors may have lost hundreds of billions of dong to Coolcat. (VND1 billion = $43,500)

Coolcat advertised itself as an insurance investment firm which has been operating for five years. It claimed to be headquartered in the U.K. and licensed by the Securities Commission of the Bahamas. In HCMC, the company advertised its office on Binh Thanh District's Nguyen Huu Canh Street.

The platform boasted it had six million members all over the world, was highly regarded by international financial management institutions, and the only insurance company with all its transaction capital kept in Vietnam, so members could rest assured of complete safety "with no fear of losing money."

It has been reported that in December last year, Coolcat organized an opening ceremony at a five-star hotel, with several foreigners onstage. Following some other events that it organized, many were convinced that Coolcat was the real deal, even though they were not aware of its legality.

To join Coolcat, investors had to install its app on their mobile phones, sign up for an account and receive a transaction ID. The platform presented six insurance investment packages, where the more money one invested, the better the returns were. The lowest value package, costing VND1.3 million ($56.40), would return VND60,000 a day, or 4.6 percent. The highest, costing VND210 million, would return VND9.7 million a day.

Each day, investors would have to guess whether the price of gold, foreign currencies and cryptocurrencies like Bitcoin would rise or fall. They gained or lost money depending on whether they were right or wrong. Losing six times in a row would force block an investor, and Coolcat experts would make the seventh guess for them with up to 90 percent chance of winning. If the seventh guess still turns out wrong, Coolcat would reimburse all the money lost in the previous guessing rounds.

Coolcat claimed that its platform would help investors retain all their capital while still gaining money every day.

Besides the predicting game, Coolcat also allowed investors to bring in more people to join the platform and receive up to VND1.8 million each time.

On April 15, just one day before it disappeared, Coolcat announced it would raise the referral bonus to VND46 million. The announcement prompted investors to frantically introduce their acquaintances to the platform, only to be tricked the following day.

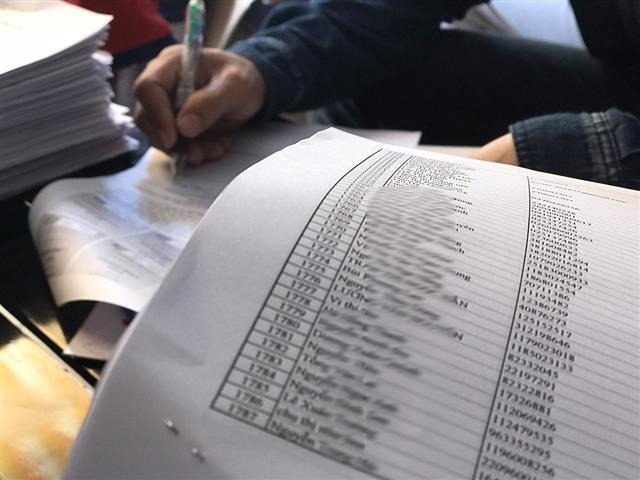

A censored list of over 1,800 names of Coolcat's victims. Photo by VnExpress/Viet Anh.

|

Greed, gullibility

Believing in Coolcat's lies, several investors gave the platform hundreds of millions of dong on April 14 and 15, but when they visited its office in Binh Thanh District, they found out it was a fake address.

Reporting what had happened to the police, Mai Thanh said she doesn’t know how to let her husband know it. In February, she borrowed VND115 million from him, saying it was for a birthday party, then borrowed an additional VND50 million herself and invested them all in Coolcat. After spending a week on the platform and seeing the gains, she decided to pour in another VND400 million.

"I thought I could go in then go out quickly, so whenever I got my returns I would withdraw them. But that only worked the first few times, giving me some tens of millions of dong. Then it shut down," she said.

Chi Thien, 32, sat next to Thanh and guided the investors on filing their complaints. He said he didn’t expect the VND640 million he’d saved for his marriage to simply vanish into thin air.

In February, he opened 11 accounts on the platform, and planned to use his returns for the wedding and the rest for his savings.

"I only managed to withdraw 10 percent of what I invested. Now I don’t know how I can hold a wedding," he said.

There are over 1,800 names in the list of Coolcat’s victims. One woman reported losing VND1.9 billion, the highest amount reported in the list. Thien said Coolcat had over 68,000 members, based on his own deductions by looking at recently registered transaction IDs.

In the national database for registered businesses, managed by the Ministry of Planning and Investment, there is no mention of any company called Coolcat.

Phan Hoang Khanh Nguyen, a lawyer with the HCMC Bar Association, said Coolcat operated a pyramid scheme but was not registered with authorities. Apart from swindling their members, the firm has shown signs of "obtaining property by fraud" and committing "offences against regulations of law on competition."

He said that to pursue their rights, victims of Coolcat should continue filing accusations with the police and keep the investigation going, especially targeting individuals behind bank accounts that received the investment from the victims.

Nguyen Hoang Son Le, an investment expert, said the trick used by Coolcat was not uncommon and has been reported by the media several times.

"Investors were tricked because they were too greedy for the returns, forgetting the most fundamental principle of investment; that the higher the returns are, the greater the risk is."