Vietnam stock market predicted to surpass 1,200-threshold in mid-term

Vietnam stock market predicted to surpass 1,200-threshold in mid-term

For 2021, the firm expected Vn-Index to fluctuate in range of 1,070-1,250.

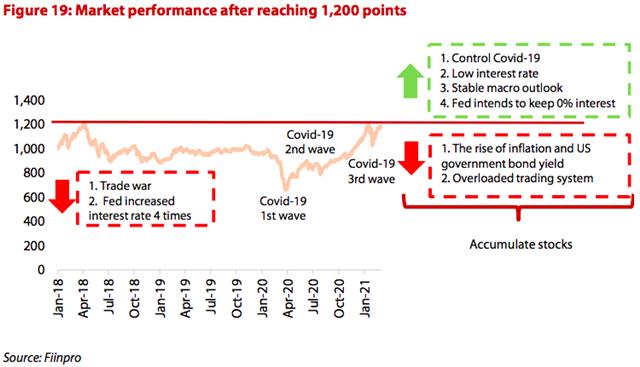

Vietnam’s stock market is expected to surpass the 1,200-threshold in the second half of 2021, especially as the country continues to maintain its current easing monetary policy to support economic recovery, according to Viet Dragon Securities Company (VDSC).

|

Meanwhile, in short-term, the benchmark Vn-Index is likely to struggle to break the 1,200 in short-term, in which the VDSC cited the upward movement of inflation and US 10-year government bond as reasons.

According to the VDSC, many stock markets started to correct when the yield of 10-year US government bonds increased by more than 16 basis points to 1,6% as of February 25 (the highest level since February 2020), including the negative movements in the last week of February of major indices such as Nikkei (-3.50%), SET (-0.94%), and SP500 (-2.44%).

Vietnam’s market also aligned with global market but experienced a less fierce correction on a weekly basis (-0.42%). However, the strong selling pressure also happened with a reduction of 15 points (-1.33% on a daily basis) on February 24.

“Therefore, watching central banks behavior is critical to evaluate potential stock price movements,” noted the VDSC.

Another issue that limit the growth of the stock market is the overloaded trading system. The VN-Index sporadically freezes in trading when the market volume reaches around VND14 trillion (US$606.3 million) due to overloads of orders on the HOSE trading system.

It hampers further upside potentials of the VN-Index as new investors would find it difficult or be confused to place orders, noted the VDSC.

Many efforts in the short-term are recommended such as increasing the trading lot from 10 to 100 shares per lot (started in January 2021), and moving some stocks in HOSE to HNX, but the effect is still not measurable, it added.

“Currently, investors expect that the application of the KRX system from South Korea at the end of 2021 would completely solve the overloaded orders problem,” but adding the timeline stays far away by late 2021.

At last week's Dialouge 2045 between government leaders and the business community, Chairman of the National Private Economic Development Research Board Truong Gia Binh expects strong mutual trust among the government, enterprises and the people.

In this regard, Binh expected Prime Minister Nguyen Xuan Phuc to allow private enterprises to solve the existing problems of Vietnam’s stock market.

Chairwoman of budget carrier Vietjet Nguyen Thi Phuong Thao said it would cost HOSE millions of dollars to solve the current technical issues, suggesting the businesses could join hands in this efforts.

Favorable mid to long-term outlook

Despite these short-term risks, the VDSC said the stock market’s mid to long-term positive outlook continue to stay.

According to the VDSC, the low-interest rate environment is still an unprecedented catalyst to support the stock market in 2021.

|

The deposit interest rate has not shown sign of going up as the rate of six to 12 month of the whole banking industry in February was on a 4% to 6% range (versus average of 6% in the same period last year) and almost sideways compared to the previous month.

Looking forward, as stated earlier, the risk of higher interest rates given the raise of inflation in February would be noticeable.

However, until now, it is still controllable given the government’s effort such as using the petrol price stabilization fund to offset higher global oil prices. Therefore, stock market is still an attractive channel for investors given low banks’ deposit rates.

|

“From a psychological perspective, it would take time to test this zone [1,200 points] but positive prospects in mid to long-term outlook outweighs those concern,” it noted.

“Therefore, it would be appropriate for investors to avoid “buy on the rise” and consider accumulating stocks having promising outlook in 2021 in strong volatile trading sessions,” reiterated the securities firm.

For 2021, the firm expected Vn-Index to fluctuate in range of 1,070-1,250.

The Vn-Index ended the final trading session of last week at 1,168.69, an increase from 0.22 points or 0.02% against the previous one.