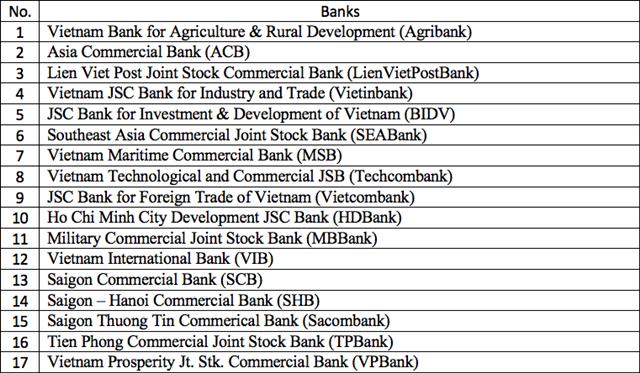

Vietnam names 17 major banks in finance system

Vietnam names 17 major banks in finance system

Banks in the list are classified as important pillars to the finance-banking system, and therefore subject to close credit risk monitoring and warning under the SBV’s instruction.

The State Bank of Vietnam (SBV), the country’s central bank, approved a list of 17 major credit institutions and foreign branches in the country’s finance-banking system in 2021.

|

The list included four major state-owned commercial banks, namely Agribank, Vietinbank, Vietcombank and BIDV, with combined registered capital making up 23.1% of the total in the banking system as of last August.

Transactions at Eximbank. Photo: Viet Dung

|

The SBV estimated 17 banks in the list account for 70% of total outstanding loans in the system, while urging bank inspection and supervision agencies to continue closely monitoring risks related to the operation of these banks and prevent any major impacts to the local credit system.

Banks in the list are classified as important to the system, and therefore subject to credit risk monitoring and warning system under the SBV’s instruction.