Robust economic pickup to drive stronger credit growth in 2021

Robust economic pickup to drive stronger credit growth in 2021

Real estate sales will be another key driver of credit growth, as apartment supply and sales are likely to pick up in 2021.

Fitch Solutions, a subsidiary of Fitch Group, forecast Vietnam’s credit growth to be 12% in 2021, in line with the target set by central bank, and up from an estimate 10.1% in 2020.

“Improving optimism around the general business outlook as external demand and the global economic recovery firms up over the course of 2021 will drive stronger credit demand, especially amid low interest rates,” stated Fitch Solutions in a note.

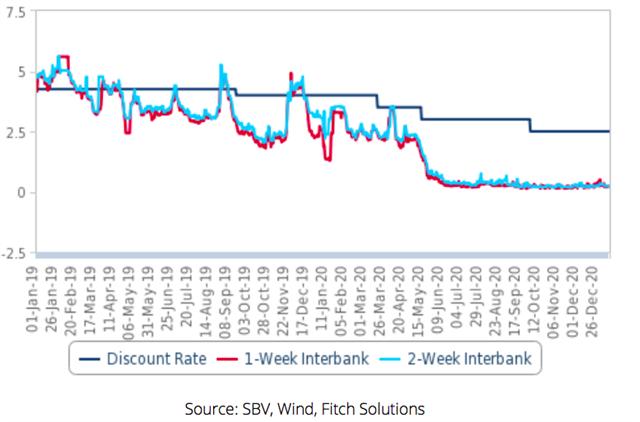

Meanwhile, the agency expected the State Bank of Vietnam (SBV), the country’s central bank, to hold its policy discount and refinancing rates at 4.00% and 2.50% over the year, given that almost rock bottom interbank borrowing rates indicate already surplus liquidity in the system.

Vietnam – Credit Growth, %

|

Vietnam’s credit growth logged a significant acceleration in the final quarter of 2020 to hit 10.1% year-on-year in December 2020, from 6.1% in September 2020 as compared to the end of 2019.

This was in line with a pick-up in real GDP growth to 4.5% year-on-year in the fourth quarter of 2020, from 2.7% in the previous ones, as the effective containment of the Covid-19 outbreak in Vietnam facilitated a further normalization of domestic activity, asserted Fitch Solutions.

Moreover, automotive purchase loans also likely supported the credit growth acceleration in the second half of 2020, as the government slashed vehicle registration fees by 50% for the purchase of domestically produced vehicles until end-2020.

Fitch Solutions expected stronger economic activity in 2021 - in which it forecast real GDP growth of 8.6% - driven by manufacturing, construction, and services, to spur higher loan demand over the year.

Vietnam – SBV Discount Rate Vs Short-Term Interbank Borrowing Rates, %.

|

In particular, trade gains from the EU-Vietnam Free Trade Agreement (FTA), UK-Vietnam FTA, and the RCEP would provide a further thrust to export manufacturing on top of the gains in production since 2018 which would come from manufacturing supply chain relocation from China, stated Fitch Solutions.

Real estate sales will be another key driver of credit growth. Apartment supply and sales are likely to pick up in 2021, according to CBRE, and this will also drive higher loan demand through the mortgage segment.

Meanwhile, Vietnam’s strong manufacturing growth momentum will also continue to attract investors in its industrial real estate market, with stronger economic activity in general driving demand for office space from services sectors such as financial services and information technology.

Fitch Solutions also predicted inflation to average 3.5% in 2021, which is below the government’s 4% target for the year. As such, this would result in long term low interest rates.

“In particular, we expect easing food inflation over 2021 to offset higher transport inflation,” Fitch Solutions asserted.