BAC A BANK’s stellar growth with green focus

BAC A BANK’s stellar growth with green focus

Established in 1994, locally-invested BAC A BANK has weathered all difficulties to grow from strength to strength in an effective manner, suitable to the sustainable socioeconomic development strategy of the country as a whole.

BAC A BANK has continued to scoop up awards in recent years as it improves assets, safety, and effectiveness

|

Since its establishment, BAC A BANK has borne in its mind a major mission on business with sustainable development, creating environmentally-friendly veritable values for the community. The bank’s set development orientation has been to focus on providing investment consultancy for customers who operate in agricultural and rural development, healthcare, education, and supporting industries for agriculture, contributing to creating a green and safe ecosystem.

Climate change and environmental pollution have become among major challenges facing all nations. At present, the country’s economic growth goal embraces not only rapid growth but also sustainability. This is also a key policy set out by the 11th National Party Congress, stating, “It is a must for the country to accelerate economic restructuring closely linking with the renewal of the economic growth model from quantitative development to suitable quantitative and qualitative development. Especially, it is necessary to connect economic development with environmental protection, with the development of a green economy.”

Accordingly, the State Bank of Vietnam’s scheme on developing green banks was approved in Decision No.1604/QD-NHNN dated 2018, underlining the role of the banking sector in providing active support for the economy to pursue green growth.

For the public, organisations, and businesses, green credit is an important solution that can help reduce negative impacts caused by daily activities and production to the environment and the society, contributing to the economy’s sustainable production. Meanwhile, for banks, the provision of green credit programmes can help them decrease outstanding debts, increase financial stability, and protect their images and brand names in the market.

Green credit, or green lending, refers to a lending dependent on environmental criteria for the planned use of funds. It is part of the wider sustainable investing and aims to reduce the impact on the environment of new lending activities.

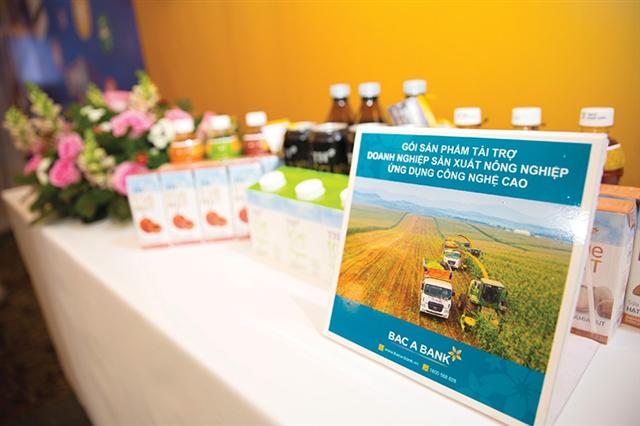

BAC A BANK is focused on providing investment consultancy for projects with sustainable development and application of high technology

|

Offering green credits

Back in 2012, BAC A BANK announced a long-term development strategy, which stated that it is necessary to boost high-tech application and introduce the world’s modern technologies into production in order to modernise the Vietnamese agricultural sector, ensuring that all projects that receive funding and consultancy from BAC A BANK will be implemented in a serious and professional manner.

To materialise the bank’s great vision on prioritising the development of green credit, it formulates a portfolio of projects with sustainable development which can have positive impacts on the environment in order to provide investment consultancy and credits for. In addition, it appraises all impacts that the projects can have on the natural environment and social welfare during the process of making a decision about providing investment consultancy and credits.

Furthermore, BAC A BANK frequently assesses the effectiveness of the implementation of the projects regarding the environmental factor, and supplements and perfects product packages in service of green credits, such as providing credits for agricultural high-tech businesses, agricultural co-operatives, and farmers who produce fruit and vegetables.

Over the past 26 years, the bank’s nonstop efforts in creating core values both economically and socially have been demonstrated by big successes of many projects it has been supporting.

For instance, one of the most outstanding projects with BAC A BANK’s investment consultancy is TH Group’s $1.2-billion venture in the central province of Nghe An, featuring a state-of-the-art dairy cow farm and fresh milk production plant, which currently has more than 45,000 dairy cows and capacity of 500,000 tonnes of fresh milk a year. This project now provides more than 40 per cent of fresh milk materials in Vietnam. In 2015 it was recognised as “the most concentrated large-scale high-tech dairy cow production project in Asia” by the Asian Book of Records, and received the Enterprise with High-tech Application certificate from Vietnam’s Ministry of Agriculture and Rural Development.

After successfully implementing this project in Nghe An, BAC A BANK has also provided investment consultancy for many other projects in many localities nationwide such as Thanh Hoa, Ha Giang, and Phu Yen. In the time to come, it will also do the same for a number of other projects in Kon Tum, An Giang, and Cao Bang. All the farms will supply a huge volume of fresh milk for domestic consumption and export to China.

In addition, under the bank’s support, TH Group is also developing a concentrated large-scale high-tech dairy cow production project in Russia, with total investment capital of $2.7 billion.

Besides providing financial and investment consultancy for these types of initiatives, BAC A BANK has also been carrying out similar projects on preserving and producing clean medicinal herbs and natural flavouring; planting and exporting high-quality vegetables and rice; wood processing and sustainable afforestation; and production of pure mineral water and fruit juice. All these projects have been developing strongly and sustainably, creating impressive products and winning the confidence of domestic and overseas consumers, as well as contributing to enhancing the quality of the life and health of Vietnamese people.

Impressive business results

Over the years, BAC A BANK has significantly improved the quality of its assets, and its safety and effectiveness indexes. As of late last year, the scale of loans has continued growing to a high level, with the quality of the loans always ensured.

The ratio of loans for the rural, agricultural, healthcare, and educational sectors accounted for the majority of the total loans offered.

In order to improve its investment effectiveness, BAC A BANK has also reviewed all of its investment portfolio, helping to control all safety indexes under new standards already set out by the State Bank of Vietnam. Furthermore, the bank has also ensured sufficient investment capital for the prioritised sectors under its sustainable development strategy.

With its persistent and strong pursuit of a green credit development policy, BAC A BANK has become one of a few banks in Vietnam taking the lead on this green development path. Along with many achievements reaped over the years, the bank last year was honoured to be presented with the Outstanding Bank for Green Credit Award at the 2019 Vietnam Outstanding Banking Awards for its pioneering role in green credit promotion and contributions to the country’s sustainable development and environmental protection.

In the context of rapid technological development, the landscape for green loans remains promising and in need of many other lenders like BAC A BANK.