Vietnam c.bank set for 5th policy rate cut to realize GDP growth target

Vietnam c.bank set for 5th policy rate cut to realize GDP growth target

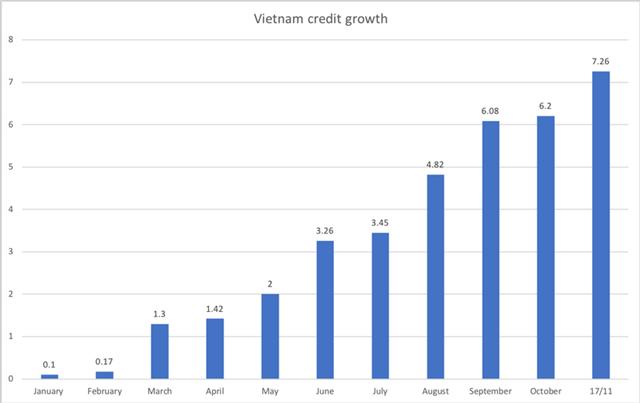

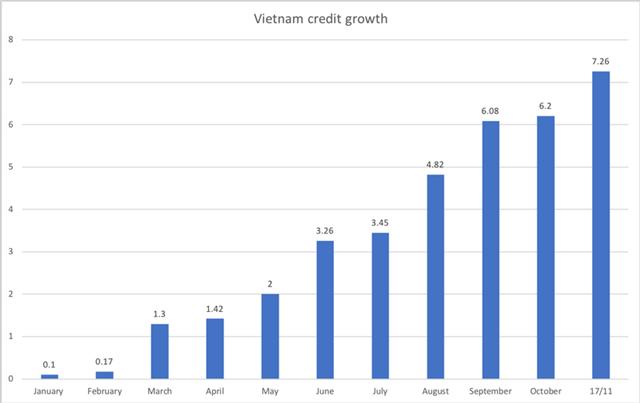

As of November 17, the country’s credit growth was estimated at 7.26% against the end of 2019, resulting in VND8,790 trillion (US$377.7 billion) in outstanding loans.

As inflation could further ease in the coming time as a result of declining pork prices and low petroleum and gas prices, the State Bank of Vietnam (SBV), the country’s central bank, could cut its policy rates for the fifth time this year to ensure the economy realizes its growth target of 2.5 – 3%, according to KB Securities Company (KBSC).

The State Bank of Vietnam.

|

A low capital mobilization rate, therefore, would have a positive impact on banks’ net income marginal (NIM), stated the KBSC in a report.

Since the beginning of the year, the SBV has lowered its interest rate caps four times to support the economy amid Covid-19 impacts, with the latest made on September 30 by slashing 0.5 percentage points to the refinancing interest rate, discount interest rate, overnight lending rate, and interest via open market operations (OMO).

Accordingly, the refinancing interest rate is down from 4.5% per annum to 4%, rediscount rate from 3% to 2.5%, overnight interest rate from 5.5% to 5% and interest rate via OMO from 3% to 2.5%.

The SBV also lowered the interest rate cap to 4% annually from 4.25% for deposits with maturities of one month to less than six months.

Meanwhile, the SBV ordered banks to lower the maximum lending rate for short-term loans to 4.5% from 5%, with the aim of helping companies operating in the fields of agriculture, high-tech industries and exports, among others. Similarly, that rate at people’s credit funds and micro finance services is down from 6% to 5.5%.

Credit growth set to hit 9 – 10% in 2020

Chart: Hai Yen.

|

As of November 17, the country’s credit growth was estimated at 7.26% against the end of 2019, resulting in outstanding loans of VND8,790 trillion (US$377.7 billion), significantly lower than the rate of 10.28% in the same period last year.

As such, credit expanded by nearly one percentage point in the first half of November against late October, or VND90 trillion (US$3.86 billion), indicating the economic recovery following Vietnam’s effectiveness measures in containing the Covid-19 pandemic.

By the end of the third quarter, credit growth of listed banks averaged 7.5% year-to-date, in which state-run commercial banks (except Agribank) posted a modest credit growth rate of 3.6% and joint-stock banks 12.5%.

Notably, strong growth in corporate bonds had significantly contributed to high credit growth in the three-quarter period in a number of banks, including Techcombank, VP Bank, and Military Bank, among others. As credit growth rates at some commercial banks are now exceeding the limit set by the SBV in the beginning of the year, the central bank has set higher limit for credit growth for banks in the third quarter.

For this year, KBSC forecast Vietnam’s credit to expand by 9–10%, equivalent to an increase of VND180 trillion (US$7.77 billion) in outstanding loans in the rest of the year, given positive economic outlook.

In this context, the SBV could allow some banks to increase credit growth limit in the fourth quarter, including HD Bank or TP Bank, KBSC suggested.

Fitch Solutions, a subsidiary of Fitch Group, predicted credit growth to weaken to 7% in 2020 from 13.7% in 2019. Nevertheless, as Fitch Solutions expected Vietnam’s GDP growth to reaccelerate to 8.2% in 2021, it predicted credit growth to pick up to 12%