What the data says about business pandemic resiliency in Vietnam

What the data says about business pandemic resiliency in Vietnam

We have been hearing a lot of expert opinions lately about businesses resiliency in Vietnam during the COVID-19 pandemic. But expert opinion can reflect subjective bias, or a hidden agenda rather than actual data, of which so far there has been little.

Claude Spiese - Senior advisor for Digitech Innovation Grant Thornton Vietnam

|

Grant Thornton Vietnam decided to address this situation by running a survey and conducting a diagnostic to assess business pandemic resiliency, and the factors that may or may not explain resiliency, including six key aspects of business operations – finance, supply and demand, external factors, people, and digitalisation. Some of the results were expected and consistent with our prior subjective bias, but others were surprising.

Based on self-assessment by the companies participating in the diagnostic, 56 per cent of companies experienced a huge negative impact of higher than 20 per cent of earnings, and only 19 per cent of companies experienced a modest impact lower than 10 per cent. State-owned enterprises (SOEs) were more resilient than foreign-invested and private Vietnamese companies, but listed companies were the least resilient.

This was perhaps the first surprising result. Are SOEs truly more resilient, perhaps due to protections they enjoy provided by the state? Or could it be that some survey participants were not totally correct in their survey answers?

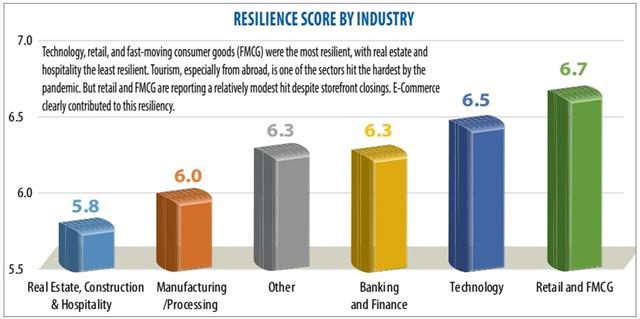

Retail and fast-moving consumer goods companies tended to be strongest in digital factors but weakest in people and financial factors; technology companies were unsurprisingly strongest in digital factors but weakest in supply and demand factors; banking and finance companies were unsurprisingly strongest in finance factors but weakest in supply factors; manufacturing companies tended to be strongest in finance but weakest in supply; and real estate and hospitality companies tended to be strong in digital factors but also weak in supply.

|

In summary, we can see that supply was disrupted by the pandemic. Also of note is that people factors were rarely a problem, but rather contributed to business resilience.

The diagnostic provided each survey participant with a custom report, which included a benchmark against their industry for each of the six factors.

This allowed companies to see where they stand versus their peers. The diagnostic also provided three custom recommendations to each company to improve their resiliency, based on their individual strengths and weaknesses.

A review of the recommendations revealed some insights which form part of the story of how businesses define a common practice for resiliency during the pandemic. Three recommendations – increasing online channels, protecting your business from cyberattacks, and increasing diversity of your supply chain – were most commonly made, and were applicable for most smaller companies.

This suggests that the most resilient companies have a strong online presence, have invested in IT security systems, and have a wider variety of suppliers. This data points to these conclusions, so it may be worthwhile for business owners and managers to consider.

Also recommended for some participants was to provide work-from-home (WFH) training; upgrading IT systems to improve analytics; and updating your business continuity plan. WFH – the newest, hottest term to gain traction in the COVID-19 pandemic, has actually been pushed by many consultants for quite some time already.

Not only consultants, but also the media were pushing in this direction with concepts such as “new work culture”, and “new management style”. Putting WFH into practice, however, was considered a headache by management, and was often delayed or deferred as a low priority.

Surprisingly, the diagnostic revealed that shifting to WFH was not such a big problem after all, at least not when there really was no other choice.

It might have seemed challenging at first with all the changes it brings, but the data suggests that most companies are doing just fine with their deployment of it. To update an old truism, necessity is the mother of innovation.

The results of the diagnostic should of course not be blindly believed. The sample size was not especially large, and surely there may have been some fudging of answers by the participants about their business performance.

But all in all, the results provide a valuable starting point to analyse resiliency in the Vietnamese context, and to supplement anecdotes and subjective opinions.