Vietnam to benefit most from upcoming review of MSCI Frontier Markets Index

Vietnam to benefit most from upcoming review of MSCI Frontier Markets Index

Vietnam could see a weight increase of 13% in the Frontier Markets Index to become the most important market in this Index.

After Kuwait was upgraded to the Emerging Market status, Vietnam is set to benefit the most from the reclassification of the MSCI Frontier Markets Index in November, according to Viet Dragon Securities Company (VDSC).

|

Vietnam could see a weight increase of 13% in the Frontier Markets Index to become the most important market in this Index, the securities firm noted.

However, MSCI has just suggested a gradual weight reduction for Kuwait once per quarter for one year, starting in November 2020 and ending at the review period of November 2021. If so, instead of reducing Kuwait’s to 0% and rebalancing the weights of other countries in the MSCI Frontier Markets 100 Index in November, this could take longer than expected.

The reason for this proposal is to avoid market volatility and to facilitate restructuring since Kuwait’s weight in the MSCI Frontier Markets 100 Index is fairly large.

|

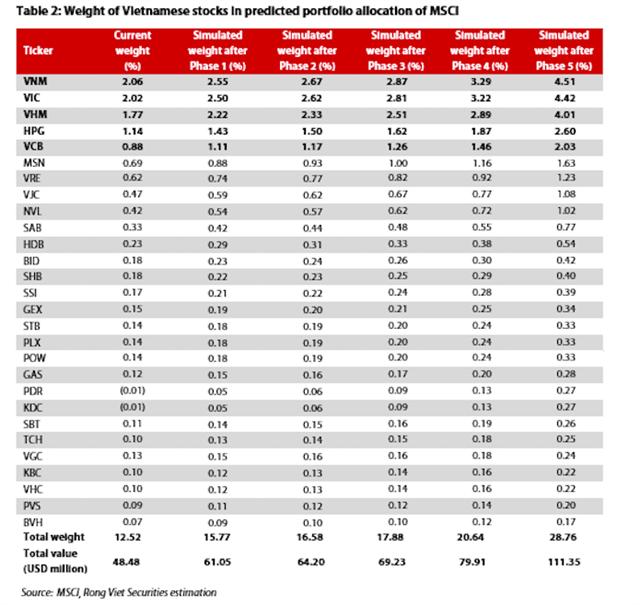

According to VDSC, capital would flow into stocks in the VN30 Index – formed by the 30 largest and most liquid stocks listed on the Hochiminh Stock Exchange, especially those accounting for a large proportion in MSCI.

In particular, net money inflows are estimated at US$63 million into stocks including VNM (US$9.5 million), VIC (US$9.3 million), VHM (US$8.7 million), HPG (US$5.7 million), and VCB (US$4.5 million).

However, the value of capital inflows could be higher than VDSC’s estimate because it does not count active funds and other funds benchmarking this index.

As the gradual removal of Kuwait stocks from MSCI Frontier Markets 100 Index would take place in five review periods, capital inflow would be US$12.6 million in phase 1, another US$3.1 million in phase 2, US$5 million in phase 3, US$10.7 million in phase 4, and US$31.4 million USD in phase 5.

As a result, the weight of Vietnam in the MSCI Frontier 100 Index could be raised to 28.76%, from the current 15.76%, in turn solidifying the uptrend of the VN-Index in the upcoming years.

MSCI‘s final decision will be announced on November 9, 2020. On April 8, 2020, MSCI decided to upgrade Kuwait from frontier market to emerging market at the semi-annual index review in November 2020.

Vietnam is set to follow Kuwait’s footstep in the next full annual review of global provider of financial services FTSE Russell by September 2021, as the country is working to resolve its outstanding issues, said KB Securities Vietnam Company.

Vietnam is currently in the Frontier Market group, and was added to the FTSE Russell’s watchlist for possible upgrade to Secondary Emerging Market in September 2018. However, after one year of review, Vietnam only met seven out of the nine criteria of FTSE.