Vietnam inflationary pressures predicted to remain weak in 2020 – 2021

Vietnam inflationary pressures predicted to remain weak in 2020 – 2021

Vietnam’s inflation is set to remain below the government’s 4% threshold for most of the year with its average forecast at 3.5%. This should see the central bank keep lending conditions accommodative into 2021.

Vietnam’s inflationary pressures are predicted to remain weak in the 2020 – 2021 period, despite aggressive monetary easing by the State Bank of Vietnam (SBV), according to Fitch Solutions, a subsidiary of Fitch Group.

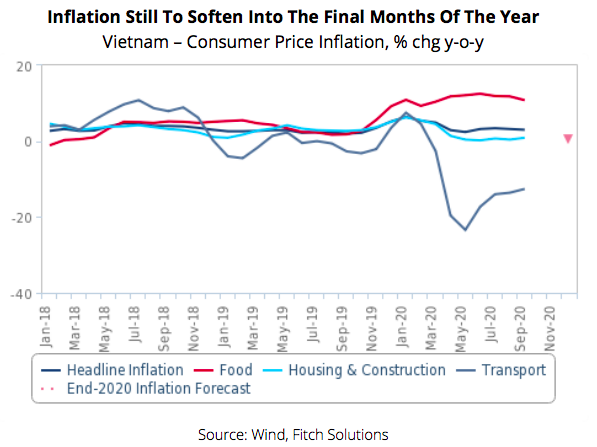

This is due to excess capacity in the economy as a result of the slowdown as well as weak demand. Noting an average inflation of 3.2% year-on-year over the first nine months of 2020, with the September print at 3.0% year-on-year, Fitch Solutions has revised down its inflation forecast to an average of 3.3% year-on-year for the full year, from 3.5% previously, with inflation set to dip in the final months of the year due to high base effects from 2019.

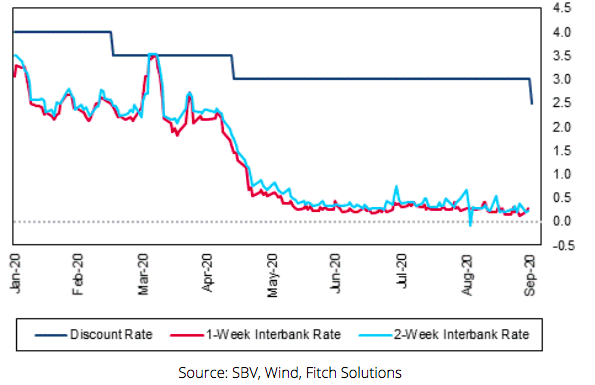

Excess Liquidity PersistsVietnam – Policy Discount Rate Vs Short-Term Inter-Bank Borrowing Rate, %.

|

The forecast also reflects Fitch Solutions’ view for inflation to come in safely under the government’s 4.0% threshold.

While food inflation has been high, transport price deflation as well as a softening of inflation in housing and construction materials has aided a softening of headline inflation over most of 2020.

|

High food inflation is likely to subside from the final two months of 2020 and into 2021 on the back of high base effects from a reduced hog herd at the end of 2019 as a result of the African swine fever outbreak in Vietnam.

Meanwhile, lower year-on-year oil prices will also see transport price deflation persist into the first quarter of 2021 before returning to inflation. Accordingly, Fitch Solutions’ forecast Brent oil price to average US$44.00/bbl in 2020 and US$51.00/bbl in 2021, versus US$64.16/bbl in 2019.

More broadly, inflation should pick up along with a demand recovery in 2021, but Fitch Solutions still expected the headline print to come in below the government's threshold for most of the year, with its average forecast at 3.5%.

Credit growth forecast to go up to 7%

On the other hand, Fitch Solutions has revised its credit growth forecast up to 7% from 6.5% previously.

|

This is in view of Fitch Solutions’ forecast for real GDP growth to strengthen in the final quarter of 2020, to give a full year growth of 2.6%, from an average of 2.1% year-on-year over the first three quarters, as well as some tailwinds lower interest rates will nevertheless have on loan demand.

Fitch Solutions’ forecast still reflects its view for credit growth to significantly undershoot the central bank’s 10.1% target for 2020 (which it revised in August from 14% set at the start of the year).

Despite Fitch Solutions’ revision, it continues to flag ongoing economic uncertainty as a key factor which will drag on credit demand, especially considering that Vietnam’s large manufacturing sector is heavily tied to the external outlook, which remains clouded by a resurgence of Covid-19 infections in Europe and the US, key destinations of Vietnamese exports.

Moreover, weakness in the services sector will continue despite domestic demand providing some support, given strict travel restrictions globally, and Vietnam’s continued border closure to international tourist arrivals.

A weak economic environment does not bode well for the creditworthiness of many borrowers.

As such, Fitch Solutions expected banks to continue enforcing tighter loan disbursement standards to safeguard against a sharp deterioration in asset quality, with this acting as another impediment to faster loan growth.

Indeed, credit growth as of September 22 was only 5.1% over end-2019 levels, reflecting weak demand for credit despite the SBV having lowered its interest rate caps thrice and cut its policy rates four times over 2020 thus far.

Short-term inter-bank lending rates which has fallen far below the policy discount rate also suggest already excess liquidity in the banking sector, which further informs its view for additional interest rate cuts to provide limited support to credit and economic growth.