LOGOS acquires first Vietnamese development site in greater Hanoi

LOGOS acquires first Vietnamese development site in greater Hanoi

After a recent announcement of an intitial capital investment into Vietnam of $350 million, LOGOS – a growing logistics developer headquartered in Sydney – in the morning of October 6 has officially announced that it has completed its first acquisition in Vietnam, of a 13-hectare development site located in greater Hanoi.

The acquisition follows the establishment of LOGOS Vietnam Logistics Venture last month, which has an initial forecast portfolio of approximately $350 million by gross asset value.

Render of LOGOS' first development in Vietnam located in Bac Ninh province

|

Glenn Hughes, head of Vietnam, said that the company is pleased to have acquired its first development site, having spent the last two years assessing the local market.

“Our decision to invest in Vietnam Singapore Industrial Park (VSIP) Bac Ninh Phase 1 was reinforced by major occupiers having existing facilities in the park, including FM Logistic, Emergent Cold, LinFox, and DB Schenker,” Hughes said.

He believed the property is well suited to service the growing demand from international and local logistics operators within the greater Hanoi region and is confident that the company can set a new benchmark for the Vietnamese logistics market in terms of high-quality logistics buildings to meet this demand.

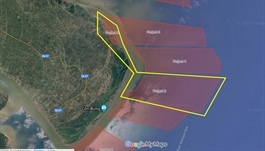

Located in VSIP in Bac Ninh province, the site offers immediate access to National Highway 1A and surrounding transport networks, and is 35 minutes from the Hanoi Central Business District and Nopi Bai International Airport, and 1.5 hours from Haiphong seaport.

The site is considered one of the key logistics locations in Hanoi and is strategically positioned for LOGOS’ customers.

Subject to relevant planning approvals, LOGOS proposes to develop the site on both a speculative and build-to-suit basis, delivering up to 80,000 square metres of high specification logistics facilities.

On completion, LOGOS Bac Ninh Logistics Estate will have an estimated end value of circa $70 million.

LOGOS is currently in discussion with a number of existing and new customers regarding this property.

The Vietnamese logistics market continues to experience strong growth driven by global trade wars, decentralisation of supply chains, and the natural evolution of the market.

Vietnam has led a successful response to the COVID-19 pandemic and is well-positioned to rebound for further growth. Occupier demand, driven by e-commerce and third-party logistics operators, remains solid as occupiers are starved of suitable logistics facilities to sustain the growth of their business operations. LOGOS’ Asia-Pacific portfolio comprises of 100 logistics estates across nine countries with assets under management of approximately $9.5 billion.

LOGOS counts some of the world’s largest fund managers as its shareholders, including ARA Asset Management, a leading Asia-Pacific real assets fund manager with a global reach, which took a majority stake in the company in March 2020.