Vietnamese coffee industry seeking growth through EU trading pact

Vietnamese coffee industry seeking growth through EU trading pact

Despite being one of the world’s leading coffee exporting countries, Vietnam has not delved deep into processing to raise the added value of the popular product. Nguyen Trung Kien from the Institute for Policy and Strategy for Agriculture and Rural Development discussed with VIR’s Song Anh how Vietnam can develop and add value to coffee to benefit from the opportunities stemming from the EU-Vietnam Free Trade Agreement.

Nguyen Trung Kien from the Institute for Policy and Strategy for Agriculture and Rural Development discussed

|

The percentage of deep-processed coffee in Vietnam accounts for only 7 per cent of total output, while raw coffee exports accounts for over 90 per cent. What is behind such a situation?

Vietnam is gradually climbing up the global coffee value chain. In 2018, the export value of unroasted, not-decaffeinated coffee stood at 84.44 per cent while instant extracts reached 10.62 per cent. Despite its limited proportion, more and more processing factories are invested in by multinational corporations and local groups.

Who are the biggest beneficiaries from the coffee value chain?

Research in 2018 by our institute showed that many farmers did not sell coffee directly to export companies. Intermediaries such as local collectors and purchasing agents were often involved in the process.

However, the amount of coffee beans sold by farmers was very little compared with that collected and sold by traders, agents, and companies. Furthermore, farmers faced higher risks than agents and companies. We also made a comparison of price fluctuations for beans at farms and those sold to collectors and companies. When global coffee prices declined, farmers’ prices also plunged to the same level. Meanwhile, other stakeholders in the chain were not affected as much by the price fluctuations.

Often, the decline of farmers’ coffee prices does not affect the retail price of roasted and instant products. In 2019, coffee prices dropped over 50 per cent. However, the retail price of roasted and instant coffee products continued to increase.

How do you see the trend of foreign companies investing in deep-processed coffee production to export to Europe?

The EU-Vietnam Free Trade Agreement (EVFTA) will significantly affect Vietnam’s export of instant coffee extracts, essences, and concentrates to the EU as tariffs are slashed from 15 per cent to zero. It will help the industry become less vulnerable to price fluctuations, especially in the context of falling bean prices due to global surplus.

Both local and foreign companies have made investments to expand deep-processing production. However, it is worth noting that the proportion of deep-processed coffee products to Europe remains limited. Vietnam mainly exports unroasted, not-decaffeinated products.

Although Vietnam’s coffee industry seems to enjoy opportunities from the EVFTA, many investors are not keen on deep processing. How will this trend evolve?

It is essential to create more added value and climb up the global coffee value chain. However, not every company has the strategy or capability to upgrade its production. Many companies are satisfied with expanding coffee material areas.

The government has incentives for businesses to upgrade to deep-processed coffee production and retail channels. However, only those with capability can benefit from these incentives. For some of the largest exporting countries, the value of green coffee beans accounts for a large proportion of the total output.

What movements to increase the proportion of deep-processed coffee are taking place right now?

Firstly, multinationals are ramping up presence in Vietnam, including in coffee. Local companies are also pouring money into developing large-scale deep processing. Secondly, there is an increasing demand for instant coffee, accounting for 14 per cent of global consumption. The trend is expected to increase drastically. Vietnam’s instant coffee products are becoming popular worldwide, with some even sold to some international supermarket chains. Thirdly, Vietnam has signed a wide range of FTAs, meaning that the industry will enjoy preferential tariff reductions from 5 to zero per cent.

Lastly, the government has a policy of developing the sector into a modern, synchronous, sustainable, and highly competitive one, aiming to increase proportion of deep processing for both export and the domestic market as well as enhancing the added value of the entire coffee industry.

The Ministry of Agriculture and Rural Development and relevant localities have implemented solutions to develop the coffee industry, covering some major projects like sustainable development and replanting. The ministry has also approved a national product development plan for the product.

What are the main negatives in the industry currently, and how can these be turned around?

Vietnam’s industry is faced with several challenges. Firstly, local products are currently produced and consumed mainly through fragmented value chains. Coffee processing and exporting enterprises mainly buy green beans through intermediaries, using obsolete methods based on bean size and the percentage of broken ones to classify the quality.

Moreover, Vietnam lacks a leading enterprise with strong governance, capital, technology, and marketing expertise to harness opportunities in the value chain.

Vietnam mainly exports raw coffee. Meanwhile, several businesses have yet to develop their own brands, so Vietnamese coffee is sold to the global market under foreign brands. This big disadvantage has reduced competitiveness in the international market.

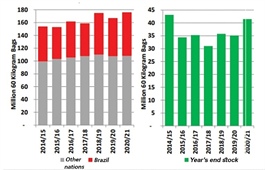

Also, the domestic consumption of processed coffee products remains low. Domestic consumption of coffee currently accounts for only about 10 per cent of Vietnam’s annual output, which is much lower than that of Brazil.

To take advantage of the new opportunities, Vietnam needs to implement solutions including developing sustainable production, improving the coffee’s quality, and reducing inefficient growing areas. We should focus on building certified growing areas, linking businesses with each other, and building a national brand for Vietnamese products.