Being best banking partner by understanding client journeys

Being best banking partner by understanding client journeys

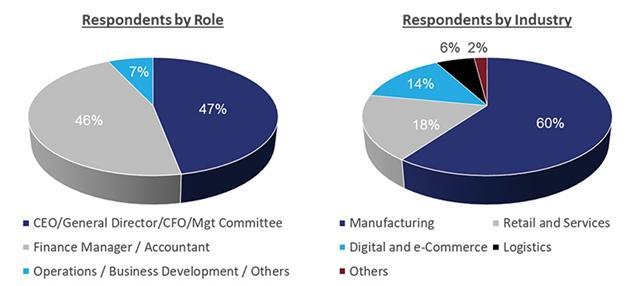

To have a deeper understanding on the impact of the ongoing pandemic on their corporate clients around the globe, Citi Vietnam launched a client feedback survey for commercial clients with close to 100 responses received over a two-week period in June. Shawn Khong, head at Citi Vietnam Commercial Bank, talked with VIR’s Phu Canh about some of the key observations from the survey, as well as how Citi and its clients can navigate the challenging climate together.

Shawn Khong, head at Citi Vietnam Commercial Bank

|

What were the main highlights coming out of the survey?

Over 35 per cent of respondents indicated a significant negative impact to their business due to the pandemic, including more than a 25 per cent decline in sales turnover or to their bottom line when compared to the prior year. Many of these companies are from the retail, digital/e-commerce, travel, logistics, and professional service industries that were impacted by a slowdown in consumption. Manufacturers, especially in the electronics, garments, and footwear supply chains saw delays or cancellation of orders especially from the US and Europe.

The survey results are broadly consistent with what has been widely reported in recent news coverage on the adverse impact that the pandemic had on businesses in Vietnam. On the upside we were happy to know that 85 per cent of survey respondents have their staff fully back in the office. Of the remainder, many planned to have at least 70 per cent of their staff returning to site by the end of last month.

Nearly 40 per cent of survey respondents expressed a preference to minimise face-to-face meetings with external parties at this moment, while nearly 60 per cent are comfortable using virtual meetings as an effective communication channel – an indication of what the new normal mode of engagement may look like going forward.

What have corporates done to overcome this challenging situation?

The top three immediate priorities for impacted corporates indicated in the survey were recovery of lost business, cash flow and liquidity preservation, and tightening expenses management. Some clients, such as healthcare companies and personal protective equipment manufacturers, are emerging from this pandemic more positively, as they were able to expeditiously modify their product lines or production capacity.

Some were able to leverage on online marketing and distribution channels – for example, companies in e-education, domestic tourism, and food delivery. Around 55 per cent expect to change business models going forward in varying degrees to adapt to a new normal. The top three focused areas of change were customer diversification/buyer’s contract terms, internal organisational change, and supplier diversification/seller’s contract terms.

We also noted that companies are more receptive to have strategic dialogues, including capital markets and fund raising, consolidation, and potential acquisition of suppliers to mitigate future unforeseen dislocations in supply chains.

|

Many Citi clients play key roles in the Vietnamese economy. What do they feel about the current economic outlook?

Some 30 per cent feel more positive about Vietnam’s economic outlook emerging from the pandemic – an encouraging signal. Nonetheless, 50 per cent are either neutral or opined that it is too soon to tell given the macroeconomic uncertainty. When asked about their outlook of Vietnam when compared to our ASEAN neighbours, we see a significant jump.

A total of 65 per cent of respondents viewed Vietnam’s prospects as more positive – a strong endorsement of the government as well as the country’s strong ability to continue to attract foreign direct investment despite an understandable slowdown in capital inflows during the pandemic period.

What is your overall assessment of the survey results?

The strong and broad-based survey participation and quality of feedback are signs that companies are willing to share their unique experiences, and open to discuss their business priorities and models under a new normal. Our clients can continue to count on Citi as their banking partner for our unparalleled global network, tailored products, digital solutions, and balance sheet support.

A huge 90 per cent of respondents indicated that they were able to continue operating their bank accounts and perform transactions effectively under continuity of business environment, with a similarly overwhelming majority of respondents rating Citi’s e-banking platform as being effective and that they were satisfied with our ability to meet their banking needs during the challenging times.

Citi will continue to proactively engage and solicit feedback from our clients to help them ride through this period of uncertainty.