Vietnamese shoppers prefer cashless payments

Vietnamese shoppers prefer cashless payments

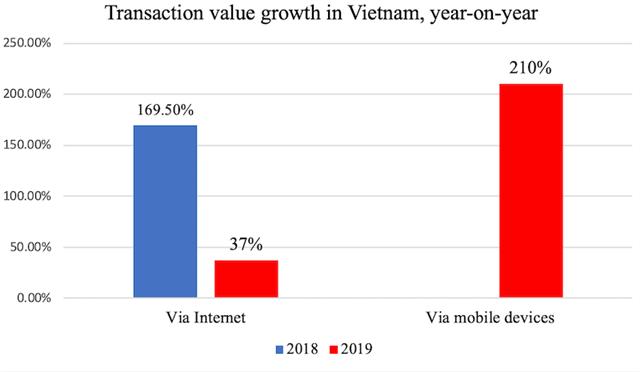

Transactions via mobile devices recorded a year-on-year surge of 198% in volume and 210% in value last year.

Vietnamese shoppers prefer using cashless payment as e-payments via internet in 2019 jumped 64% in number of transactions and 37% in value compared to 2018, according to the latest report from the State Bank of Vietnam (SBV).

Transactions via mobile devices are increasing. Photo: Tinhte

|

Statistics from the SBV showed that cashless payments grew robustly in 2019, of which, mobile payments recorded a year-on-year surge of 198% in volume and 210% in value.

In 2018, the inter-banking e-payment system safely processed transactions worth VND73,000 trillion (US$3.13 trillion), averaging US$13 billion transacted per day and up 25% year-on-year, while the transaction value through mobile payment grew 169.5% year-on-year.

According to the SBV, there are currently 127 providers of payment services via internet and mobile devices. As of May, 34 non-bank organizations have been granted licenses to provide intermediary payment services.

In particular, the transaction structure through National Payment Joint Stock Company (NAPAS) system has a strong shift from ATM transactions to inter-bank switching. The proportion of ATM transactions accounted for 62% in 2018 and 42% in 2019, while the share of inter-bank payment transactions increased to 48% in 2019 from 26% in 2018.

Source: SBV. Chart: Nhat Minh

|

In the first three months of 2020, the total transaction value through the inter-bank e-payment system surged by 21% against the same period last year.

From April 1 to 20, average transaction value through the system grew 8.85% inter-annually despite the social distancing order. To deal with the spread of the Covid-19 pandemic, many banks and telecom carriers in Vietnam have integrated e-stores and grocery chains into their payment platforms to help Vietnamese people shop online while staying at home.

The local shoppers are also using online payment platforms for bills and public services payment. Particularly, 27 banks and 10 intermediary payment service providers have coordinated with each other to collect electricity bill payment for EVN. So far, bill amount collected by the corporation through banks accounted for nearly 90% of the total revenue.

Thirty hospitals in some cities and provinces have deployed electronic fee payment. So far, non-cash fee payment transactions in some hospitals have reached 35%.

In the first three months this year, total transactions through NAPAS system increased 81.3% in volume and 145.3% in value compared to the same period of 2019.

Local consumers and businesses have also benefited from the SBV’s policy on reducing fees for money transfers, which aims to support local companies to overcome difficulties caused by the Covid-19 pandemic and encourage cashless payments.

Statistics from NAPAS showed that 39 out of its 45 banking members have cut fees for customers by 90% and some offered zero charges for fast inter-bank fund transfers of sums worth less than VND2 million (US$85) from February. The program will be valid until the end of this year.