Vietnam records over US$800-million fiscal surplus in 4-month period

Vietnam records over US$800-million fiscal surplus in 4-month period

As of April 15, budget revenue collection reached VND427.2 trillion (US$18.35 billion), equivalent to 28.2% of the year's estimate.

Vietnam recorded a state budget surplus of VND18.7 trillion (US$803.37 million) in the year to April 15, 2020, less than half the budget surplus of VN44.6 trillion (US$1.91 billion) in the same period of last year, according to the General Statistics Office (GSO).

Data: GSO. Graphic: Nguyen Tung.

|

As of April 15, budget revenue collection reached VND427.2 trillion (US$18.35 billion), equivalent to 28.2% of the year's estimate.

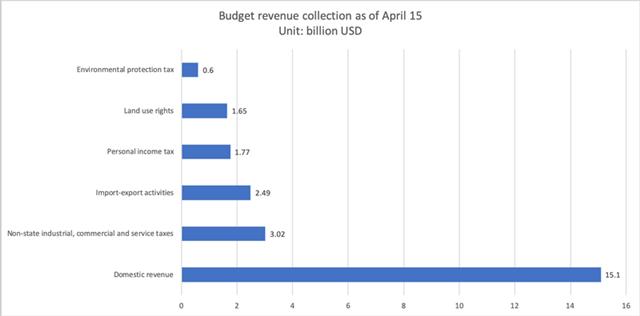

Upon breaking down, domestic revenue during the period stood at VND351.6 trillion (US$15.1 billion), equivalent to 27.8% of the year's estimate. Of the sum, the state sector contributed VND40.3 trillion (US$1.73 billion), or 22.7% of the year's estimate, the FDI sector made up VND63.2 trillion (US$2.71 billion), meeting 27.6% of the plan.

Moreover, VND70.5 trillion (US$3.02 billion) was collected from non-state industrial, commercial and service taxes, equaling 26% of the plan, and VND14.1 trillion (US$605.8 million) from tax on environmental protection or 20.9%.

Revenue from import-export activities hit VND58 trillion (US$2.49 billion), or 27.9% of the year's estimate, and that from crude oil totaled VND17.3 trillion (US$743.31 million), or 49.1%.

Additionally, personal income tax contributed VND41.4 trillion (US$1.77 billion) to the state budget or 32.2% of the year's estimate, and land use rights VND38.5 trillion (US$1.65 billion), or 40.2% of the plan.

Data: GSO. Graphic: Nguyen Tung.

|

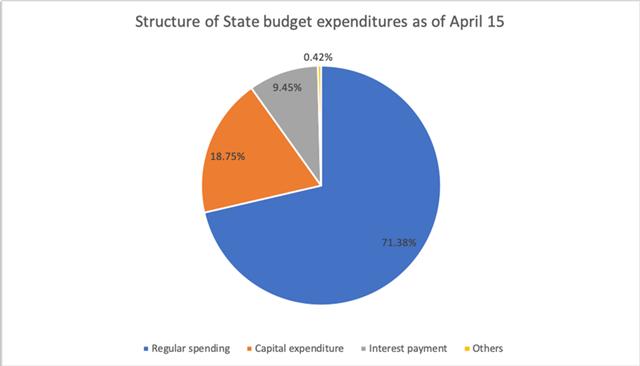

Meanwhile, state budget expenditures as of April 15 totaled VND1,211.1 (US$17.55 billion), equivalent to 23.4% of the year's plan. Of the total, regular spending reached VND291.6 trillion (US$12.53 billion) or 27.6% of the plan. Capital expenditure reached VND76.6 trillion (US$3.29 billion) or 16.3%, and interest payment, VND38.6 trillion (US$1.65 billion) or 32.7%.

In a government meeting early April, Minister of Finance Dinh Tien Dung said in the most optimistic scenario when the pandemic ends in the April-June quarter, GDP growth would come in at 5.3% and oil prices average at US$35 per barrel, the state budget may lose VND140 – 150 trillion (US$6 – 6.43 billion). The losses would be bigger if GDP grows by less than 5%.

Dung recommended government agencies, provinces and cities reduce regular spending, especially expenses related to meetings, conferences and working trips.

The Ministry of Finance estimated fiscal deficit could increase to 5 – 5.1% of GDP, significantly higher than the target of 3.4% (excluding debt principal repayments) set in December 2019.