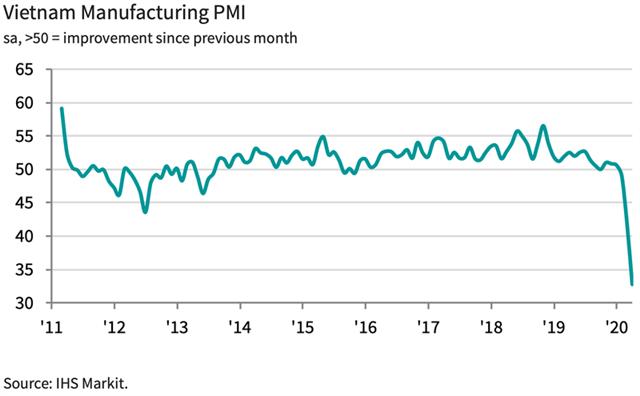

Vietnam PMI index plunges to record low level in April

Vietnam PMI index plunges to record low level in April

Record falls were seen in output, new orders, employment and purchasing amid company shutdowns and the cancellation of orders.

The headline Nikkei Vietnam Manufacturing Purchasing Managers’ Index (PMI) posted 32.7 in April, well down on the reading of 41.9 seen in March which itself had signaled a record monthly deterioration in the health of the sector, according to Nikkei and IHS Markit.

|

Business conditions have now worsened in each of the past three months.

A reading below the 50 neutral mark indicates no change from the previous month, while a reading below 50 indicates contractions and above 50 points to an expansion.

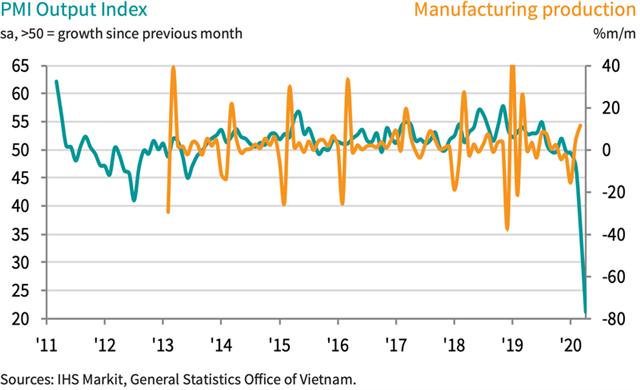

The impact of the Covid-19 pandemic was most keenly felt with respect to manufacturing production and new orders. Both fell severely during April amid order cancellations and company closures. The decline in overall new business was outpaced by that seen for new export orders, reflecting the effects of the virus in markets all around the world.

Approximately two-thirds of respondents signaled that output decreased during the month. As such, declines were registered across each of the three broad sectors covered by the survey, led by intermediate goods firms.

|

A lack of new orders fed through to a steep reduction in backlogs of work. Lower workloads led manufacturers to reduce staffing levels, while there were also some reports of employees having resigned. The resulting decrease in employment was the sharpest on record, the second month running in which a new low has been registered.

Purchasing activity also decreased at a substantial pace, linked to lower new orders, a reduction in production requirements and company closures. As a result, stocks of purchases declined sharply. Stocks of finished goods also fell, albeit to a lesser extent than in March.

Meanwhile, difficulties obtaining imported goods, material shortages and issues travelling meant that suppliers' delivery times lengthened to the greatest extent since the survey began in March 2011.

Input prices decreased for the first time in 16 months during April, and at a marked pace that was the fastest since September 2015. Panelists linked the fall in input costs to a lack of demand for inputs and lower oil prices.

With input costs falling, manufacturers continued to lower their output prices, extending the current sequence of decline to three months. The latest reduction was sharp and the joint-fastest in the survey's history, equal with that seen in June 2012.

For the first time in the series so far, firms were pessimistic regarding the outlook for production over the coming year. Sentiment dropped amid fears that the impact of the Covid-19 pandemic could last for a prolonged period. Around 40% of respondents signaled a negative outlook in April.

“The latest Vietnam manufacturing PMI report highlights the devastating impact that the Covid-19 pandemic and efforts to restrict its spread have had on the Vietnamese manufacturing sector. April saw an unprecedented decline in the sector, led by severe contractions in output and new orders,” said said Andrew Harker, associate director at IHS Markit, which compiles the survey.

“Whether April proves to be the nadir of the downturn will depend on how firms and their customers respond to an easing of the lockdown and reopening of businesses that have been closed temporarily," he concluded.