Vietnam on front foot in trade return

Vietnam on front foot in trade return

Gradual recovery from some of Vietnam’s key trade partners are plugging gaps in the disrupted global supply chain and helping the Southeast Asian nation take advantage of new opportunities arising despite the challenging times.

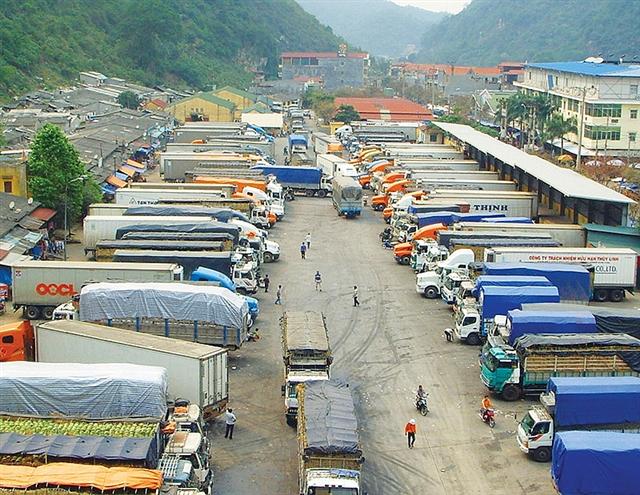

Clearance for goods on the Chinese border is now consistently on the rise again. Photo: Le Toan

|

After nearly four months of border closures as a result of the COVID-19 pandemic, in the last few days tens of thousands of containers of cargo have been cleared to move between Vietnam and China, where many major industrial companies have resumed production.

Nguyen Xuan Duong, chairman of large textile and clothing firm Hung Yen Garment Corporation, said that as the virus has been brought under control in China, import and export activities are no longer restricted. Currently, 50-60 per cent of the corporation’s materials is imported from China. “The eased trade will help us import materials more favourably, and this also provides opportunities for Vietnam to boost exports to China in the near future,” Duong said.

Sharing the positive news about supply chains and raw materials, state-run giant Vinatex started to ramp up production in the second half of March and April to make up for lost time. “As a result, garment enterprises expect to recover the 5.3 per cent decrease in export turnover from the first two months of the year,” said a Vinatex representative.

Vietnam’s trade is largely dependent on China, which purchased 15.75 per cent of the former’s total goods value last year, as well as being responsible for 29.7 per cent of Vietnam’s import value.

However, Tran Thanh Hai, deputy director of the Import-Export Department under the Ministry of Industry and Trade, pointed out that Vietnam-Chinese borders are suffering from lack of labour for loading and unloading goods, while trucks have to endure strict quarantine procedures. Still, the speed of clearance in recent days has improved compared to last month.

Major markets like South Korea and Japan have also seen improvements in the virus situation, with their economies mounting recoveries in March as a result. Over the first three months of this year, Vietnam’s exports to the Chinese market still rose 11.5 per cent on-year, while those to Japan climbed 3.5 per cent on-year.

According to the General Department of Customs, from the beginning of the year to mid-April, Vietnam’s export turnover hit $71.6 billion, of which foreign-invested enterprises held $47.9 billion. At the same time, the country recorded 12 export products with the export value of more than $1 billion.

The export turnover of goods to South Korea reached $1.76 billion in March, up 12.27 per cent on-month, bringing the total export turnover in the first quarter of 2020 from this market to $4.7 billion.

Moreover, Vietnam’s exports to Singapore are also climbing strongly. The latest figures from Enterprise Singapore show that Singapore’s imports from Vietnam in February rose 49 per cent on-month and 102.78 per cent on-year. Tran Thu Quynh, Vietnam Trade Counselor in Singapore, ascribed the situation to the city-state urgently trying to diversify its supply of raw materials in the context of interrupted supply from China. Singapore considers Vietnam a key market to help it offset the shortage of goods, especially agricultural products and seafood.

In March, this trade agency arranged more than 20 export orders from Vietnam, estimated at around 500 tonnes of goods.

Enterprises in Vietnam are also raising exports to India to reduce the risk of dependence on any single market.

Meanwhile, the International Labour Organization director in Vietnam, Chang-Hee Lee said that the Vietnamese economy is going to struggle in the next quarter due to a lack of tourists and a falling demand for Vietnamese goods in export markets, as most trade partner countries remain under lockdown.

“The seriousness of the ongoing global crisis is that it impacts both supply and demand. Under widespread lockdown, supply is severely affected, as many factories’ operations are suspended,” said Lee. “Demand falls as consumers in the US and Europe are ordered to stay at home. A problem is that Vietnam relies heavily on global trade. Therefore, we can assume that the impacts of shrinking global trade would be felt much more strongly and deeply in Vietnam for both enterprises and workers.”

Lee added that on the contrary, the outbreak has proven to be a major driver of economic growth for Vietnam’s development success story. The Comprehensive and Progressive Agreement for Trans-Pacific Partnership and the EU-Vietnam Free Trade Agreement will also offer a chance for faster recovery.

Nguyen Trung Anh, deputy general director of PAN Farm, said that this difficult period was “a test of the market”, and that enterprises should take several steps. They should improve capital management capacity, avoid relying too much on debt and especially capacity to manage risks of business interruption and emergencies, as well as review strategies to diversify the product market.

In the event that the virus can be contained in the second quarter of 2020, the country’s export turnover is projected to decrease by 20 per cent, while import turnover will likely decrease by 16 per cent.