Multinationals riding high in Vietnam’s pharma landscape

Multinationals riding high in Vietnam’s pharma landscape

Multinational corporations like Sanofi, GlaxoSmithKline, and Reckitt Benckiser gaining the advantage in Vietnam’s over-the-counter channel, or non-description drugs, in the first quarter of 2020 has in part fuelled their global performance.

Multinationals riding high in Vietnam’s pharma landscape

|

A few days ago, multinational corporations (MNCs) officially announced their first-quarter results, with many reporting good performance despite the COVID-19 outbreak. Swiss pharma conglomerate Novartis, French pharmaceutical firm Sanofi, and UK-headquartered GlaxoSmithKline (GSK) and Reckitt Benckiser have all reported positive results globally.

Particularly, Sanofi reported that the group’s total net sales reached EUR8.97 billion ($9.7 billion), up 6.9 per cent on a reported basis, while total gross profit rose 6.1 per cent to EUR6.47 billion ($7 billion).

As demonstrated in the French firm’s first-quarter report, in the rest of the world consumer healthcare (CHC) sales increased 8.1 per cent to EUR578 million ($626.6 million), driven by double-digit growth in the allergy, cough, and cold (up 17.1 per cent to EUR171 million – $185.38 million), pain (up 13.3 per cent to EUR148 million – $160.44 million), and nutritional (up 12 per cent to EUR108 million – $117 million) categories, supported by continued underlying demand as well as favourable COVID-19 impacts.

These are the segments where Sanofi is said to have performed well in the over-the-counter (OTC) channel in Vietnam between January and March. The success in Vietnam is part of the larger global mosaic of the company’s success.

As shown in FPT Securities’ April pharmaceutical update report, MNCs have been seeing profitable operations in the local pharma market during the first quarter thanks to the robust growth of consumer spending in pharmacies amid the serious development of the pandemic as consumers’ priority for now is to protect and enhance their safety.

According to market research firm Kantar Worldpanel, Vietnam’s OTC revenues rose 164-168 per cent on-year in February a large part due to the surging demand for protection masks and hand sanitiser among Vietnamese consumers.

Moreover, a rise was seen in the demand for general medicine such as the cough and cold, pain, and eye drops categories, vitamins, and the nutritional category where the majority of the market is held by MNCs.

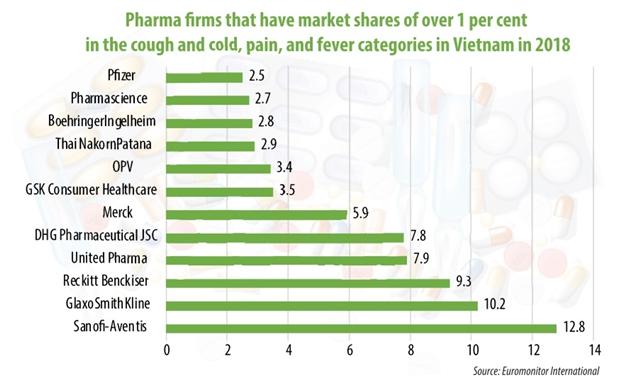

As demonstrated in an analysis by Euromonitor International, pharma firms that have market shares of more than 1 per cent in the cough and cold, pain, and fever categories in Vietnam account for 74.1 per cent of the market in the OTC segment in which foreign-made drugs account for 81.6 per cent (Panadol – GlaxoSmithKline, Strepsils – Reckitt Benckiser, Decolgen – United Pharma, Toplexil – Sanofi, and others).

Like Sanofi, the good performance in Vietnam has advanced other MNCs’ overall global results.

GSK delivered strong first-quarter results. Group sales reached £9.1 billion ($11.26 billion), a 19 per cent increase in annual equivalent rate (AER). Pharmaceuticals sales reached £4.4 billion ($5.45 billion), a 6 per cent increase in AER. Specifically, the pain relief category grew by 65 per cent AER and 68 per cent coupon equivalent rate to £611 million ($756.13 million). On a pro-forma basis, sales grew in the mid-teens per cent-wise, with significant growth of Advil and Panadol reflecting accelerated purchases as a result of COVID-19.

Meanwhile, Reckitt Benckiser saw total sales rise 12.3 per cent to £3.5 billion ($4.33 billion), with like-for-like sales up 13.3 per cent. Reckitt said growth was led by strong demand for many of its hygiene and health products, in particular Dettol, Lysol, Mucinex, Nurofen, and VMS.

In the growth group, Novartis maintained strong operational performance in the first quarter. Accordingly, first quarter net sales from continuing operations grew 13 per cent with double-digit growth in Innovative Medicines and Sandoz.

Sanofi, GSK, Reckitt Benckiser, and Novartis are expanding rapidly in Vietnam to cash in on growing local healthcare demand.

In its latest move, Novartis signed an MoU with the Ministry of Health to enlarge into primary healthcare through commune- and district-level activities for the next two years, and the inauguration of a new legal entity, Novartis Vietnam Co., Ltd. The company inaugurated the new legal entity, becoming one of the first MNCs to transform into a foreign-invested importer, rather than simply holding a representative office in the country.

In a move to develop the OTC business, GSK and Pfizer have closed the deal for a joint venture to combine the parties’ respective consumer healthcare portfolio. The move creates the world’s largest OTC business with robust iconic brands, including GSK’s Sensodyne, Voltaren, Panadol, and Pfizer’s Advil, Centrum, and Caltrate. OTC is estimated to make up about 30 per cent of Vietnam’s pharmaceutical market, while the rest belongs to the hospital system or the so-called ethical drugs channel.

MNCs are also gaining the advantage in the local OTC channel as their products are held in higher esteem than locally-made equivalents. Vietnam’s pharmaceutical market will continue to be on the radar of many more MNCs on the back of growing per capita drug spending of 10.6 per cent on-year to an estimated $53.54 in 2018, with the figure forecast to increase further in the coming time, and double-digit growth forecast in the next five years, reaching an estimated $7.7 billion in 2021 from the current $5 billion.