Mobile money pilot project submitted to PM for approval

Mobile money pilot project submitted to PM for approval

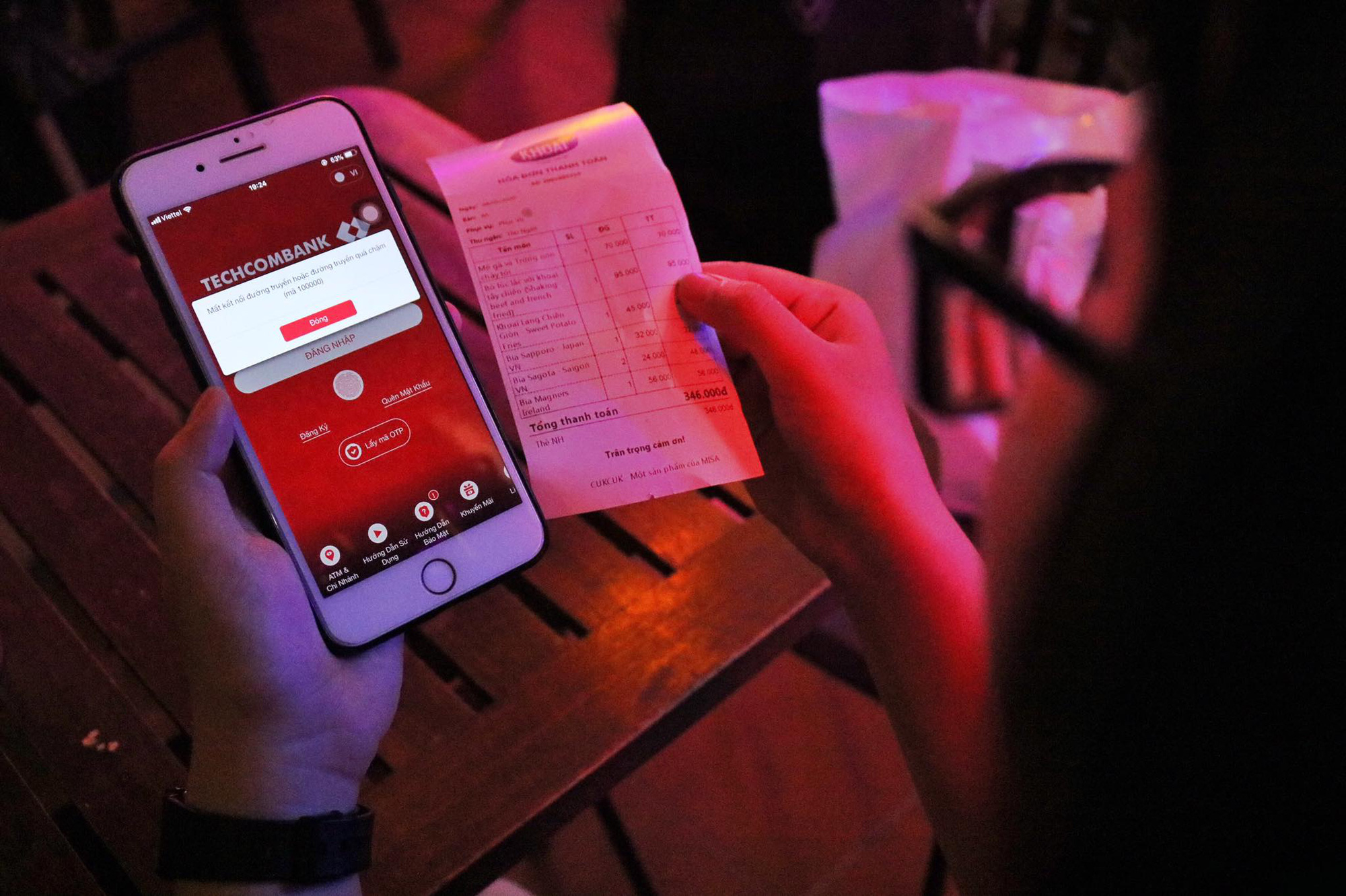

A mobile money pilot project has been submitted to the Prime Minister for approval, marking a bold step for the development of payments using telecommunication accounts in Viet Nam, Governor of the State Bank of Viet Nam Le Minh Hung said at the dialogue between the PM and the business community on Saturday.

Besides, the central bank was also hastening procedures to propose the Government the issuance of amendments to Decree No 101 on accelerating cashless payments.

Mobile money allows mobile subscribers to use their telecommunication accounts to make payments up to a limited value.

Last year, three big telecommunications service providers in Viet Nam – Viettel, MobiFone and VNPT – registered to added payment intermediary to their business lines, paying the way for participating in the mobile money market.

In Decree No 11/CT-TTg issued in early March about solutions to remove difficulties for production and business to cope with the COVID-9 pandemic, the PM asked the central bank to propose the mobile money pilot project for approval.

The use of mobile phone accounts to pay for goods and services initially got the PM’s approval in January 2019.

Minister of Information and Communication Nguyen Manh Hung previously said that mobile money created a 0.5 per cent economic growth for countries which allowed it.

According to a report of the BIDV Training and Research Institute, mobile money was present in 90 countries with nearly 870 million registered accounts, 272 apps and a daily transaction revenue averaging US$1.3 billion.

The institute said that it was necessary to develop a proper framework and enhance security for mobile money.

Viet Nam had around 129.5 million mobile subscribers, around half using 3G and 4G, and 43.7 million or 45 per cent of the country’s population using smartphones.

Many advanced technologies were being developed and applied such as biometric authentication, QR Code, tokenisation together with the development of population database for electronic know-your-customer (e-KYC).

There was also significant room for mobile money in Viet Nam with just around 63 per cent of adults (from age 15) having bank accounts, the institute cited the central bank’s statistics as saying in November.

Mobile money would also help promote financial inclusion, the institution said.

The Government targeted to reduce the ratio of cash payments to less than 10 per cent by the end of this year, from 11.33 per cent in 2019.

Mobile money would significantly contribute to accelerating cashless payments in Viet Nam where cash in circulation still accounted for 20 per cent of the country’s gross domestic product.