Hanoi office market in Q1: No new supply recorded

Hanoi office market in Q1: No new supply recorded

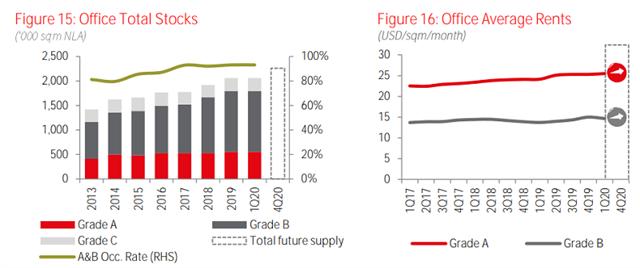

Due to the thin supply, rental continued to grow during the quarter.

Hanoi’s office market recorded no new supply in the first quarter (Q1) this year, JLL has said in a recent report.

No new supply recorded in Hanoi’s office market in Q1/2020. Photo: Doanhnhansaigon

|

In the quarter, Grade B sector remained the leading spot in the total supply, contributing approximately 66% to the market, with the largest amount located in Cau Giay district.

Regarding Grade A, Hoan Kiem district would still provide the most supply with the upcoming supplement from Capital Place in the second half of 2020. Ba Dinh district is likely to catch up in the supply amount.

The net absorption reached approximately 12,900 sq.m in Q1, a relatively good performance given the outbreak of the pandemic. However, the net absorption was mainly contributed by the on-going deals negotiated before the pandemic happened and mostly came from the newly completed ThaiHoldings Tower thanks to the building’s diverse requested sizes.

With this building, the Grade A submarket recorded higher net absorption than Grade B in the quarter.

Total stocks and average rents in Hanoi’s office market in Q1/2020. Source: JLL Research

|

Due to the tightened supply, rental continued to grow, said the report.

The average rent in Grade A&B inched up 0.6% on quarter and 5.8% on year, reaching US$17.9 per sq.m per month.

With supply constraint, many buildings were able to capitalize on the demand and adjusted their asking rents higher. Notably, in Q1, Grade A recorded higher rental growth than Grade B (Grade B rent was almost unchanged on quarter), while it was the other way round in previous quarters. This was because more limited supply and higher net absorption were recorded in Grade A than in Grade B this quarter.

According to JLL, Hanoi's office market although has yet to suffer much from the Covid-19, it is likely to do in upcoming periods due to the overall economic slowdown.

In tandem with the forecast lower economic growth for Vietnam and the world, the demand may be slightly weaker than previously predicted, since many companies will tighten their budget. As a result, landlords should consider flexible leasing strategies to attract and support their tenants.

The impact will likely be more obvious in Grade B than Grade A as the competition in Grade B is more intense with a larger supply, and tenants in this submarket also tend to be more sensitive to economic swing than Grade A.