VPBank offers lending rate cuts to firms and customers

VPBank offers lending rate cuts to firms and customers

VPBank has announced a further lending cut of 2 per cent for small- and-medium sized enterprises (SMEs), the second time it has slashed rates to support customers since the COVID-19 outbreak.

The rate cut is being offered to both existing and new customers.

For loans with collateral deposits, the maximum interest rate reduction has been set at 1.5 per cent year for VND and 1 per cent a year for US dollars. For unsecured loans, VPBank is offering a maximum annual interest rate reduction of 2 per cent year for VND and 1 per cent for US dollars.

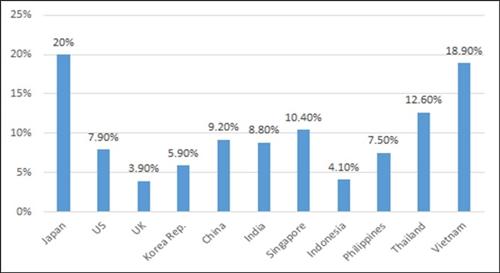

Businesses operating in the tourism, hotel and transport sectors are eligible for the cuts, along with firms whose exports to China, the US and Europe accounting for at least a half of their revenue in 2019, while importing at least half of their materials from the above mentioned markets.

Firms experiencing difficulties paying debts due to COVID-19 can also apply for loans with preferential interest rates.

In addition, businesses are required to have a good credit rating, and stable and transparent financial statuses backed up by financial reports.

A representative from VPBank said the preferential package was in response to a State Bank of Viet Nam directive asking credit institutions and commercial banks to support firms at this difficult time.

VPBank was among the first banks in Viet Nam to launch a credit package to support companies affected by COVID-19 by reducing lending rates by 1.5 per cent a year. It has also provided solutions to help firms restructure their debts. Many businesses have resolved their difficulties thank to the support package.

VPBank has encouraged its customers to increase non-cash transactions amid the pandemic by offering preferential rates for transactions through internet banking and VPBank Online such as free money transfers and adding 0.2 per cent to the interest rate for online saving accounts.

VPBank and FE Credit Company has donated VND15 billion (US$641,000) to the Viet Nam Fatherland Front’s Fund for COVID-19 Prevention and Control as well as support for doctors and medical staff.