Vietnam stock index turns world’s best performer after slump in March: Bloomberg

Vietnam stock index turns world’s best performer after slump in March: Bloomberg

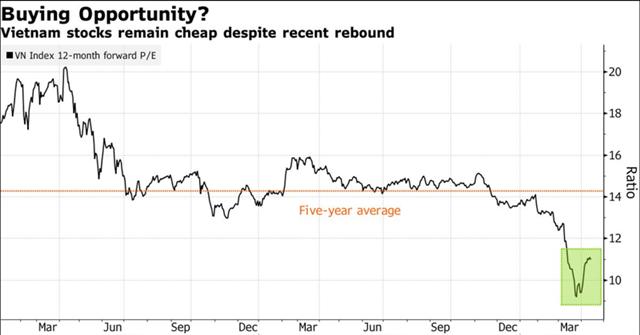

The gauge, which has been in a bear market since 2018, is trading at about 11 times estimated earnings for the next year, less than the five-year average of 14 times.

The benchmark VN-Index of Vietnam's main stock exchange has rebounded 15% in April, becoming the world’s best performer, indicating a significant rise since last month’s 25% slump due to the Covid-19 pandemic, data compiled by Bloomberg shows.

Source: Bloomberg.

|

The gauge, which has been in a bear market since 2018, is trading at about 11 times estimated earnings for the next year, less than the five-year average of 14 times, Bloomberg reported.

Vietnamese investors on the ground feel that the government has taken swift and effective measures to manage the pandemic, Patrick Mitchell, director of institutional equities at ACB Securities Company in Ho Chi Minh City told the news agency.

“The market is dominated by retail flows and the buyers have come back to super cheap valuations in the companies they like, so it makes sense to buy more at these levels with a longer investment view,” he was quoted by Bloomberg as saying.

The VN-Index fell as much as 31% this year, hitting its lowest level since December 2016 on March 24. While it has rebounded 15% since then, it remains marred in a bear market while Southeast Asian peers Thailand, Indonesia and the Philippines have entered bull territory in recent days.

The Vietnamese gauge, which was down 0.9% as of Tuesday’s midday break, remains 37% below its record high in 2018.

It seems the market is looking beyond 2020 earnings as there are some very well run businesses especially in consumption-related sectors, which were trading at very attractive valuations, said Ruchir Desai, a fund manager at Asia Frontier Capital.

To date, the Vietnamese government has rolled out supporting programs such as a credit aid package worth VND300 trillion (US$12.87 billion), a VND180-trillion (US$7.63 billion) fiscal stimulus package in forms of delay of payment of value-added tax, corporate tax and income tax, and a financial support package for vulnerable people worth VND62 trillion (US$2.7 billion).