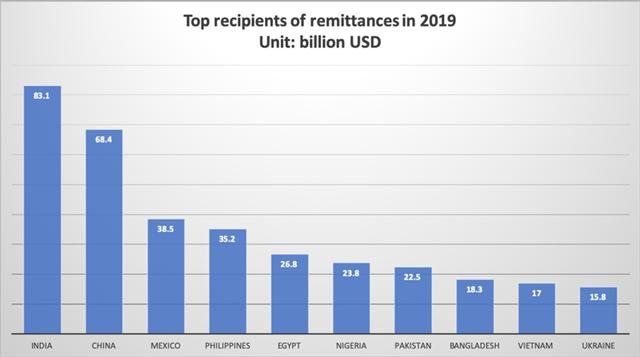

Vietnam again named among top 10 remittance recipients in 2019

Vietnam again named among top 10 remittance recipients in 2019

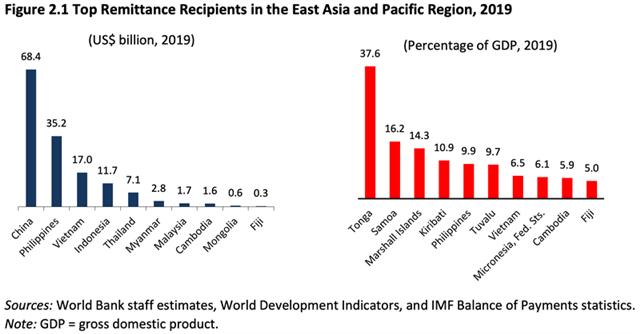

In the East Asia and Pacific region, Vietnam ranked third after China and the Philippines.

Vietnam was the ninth largest remittance recipients globally with an inflow of US$17 billion in 2019, accounting for 6.5% of its GDP and slightly increasing from US$16 billion received in 2018, according to the World Bank’s latest data.

Data: World Bank. Chart: Ngoc Thuy.

|

This was a third consecutive year that Vietnam remains in the top 10 ranking in terms of inbound remittance. The figure was US$13.8 billion in 2017 and US$15.9 billion in 2018.

In the East Asia and Pacific region, in 2019, Vietnam ranked third after China with US$68.4 billion, also the second largest recipient in the world, and the Philippines with US$35.2 billion – the world’s fourth largest recipient.

|

According to the World Bank, global remittances are projected to decline sharply by about 20% in 2020 due to the economic crisis induced by the Covid-19 pandemic and shutdown.

The projected fall, which would be the sharpest decline in recent history, is largely due to a fall in the wages and employment of migrant workers, who tend to be more vulnerable to loss of employment and wages during an economic crisis in a host country.

Remittances to low and middle-income countries (LMICs) are projected to fall by 19.7% to US$445 billion, representing a loss of a crucial financing lifeline for many vulnerable households.

“Remittances are a vital source of income for developing countries. The ongoing economic recession caused by Covid-19 is taking a severe toll on the ability to send money home,” said World Bank Group President David Malpass.

According to the World Bank, remittance flows are expected to fall across all regions, most notably in Europe and Central Asia (27.5%), followed by Sub-Saharan Africa (23.1%), South Asia (22.1%), the Middle East and North Africa (19.6%), Latin America and the Caribbean (19.3%), and East Asia and the Pacific (13%).

The large decline in remittances flows in 2020 comes after remittances to LMICs reached a record US$554 billion in 2019. Even with the decline, remittance flows are expected to become even more important as a source of external financing for LMICs as the fall in foreign direct investment is expected to be larger (more than 35%). In 2019, remittance flows to LMICs became larger than FDI, an important milestone for monitoring resource flows to developing countries.

In 2021, the World Bank estimates that remittances to LMICs will recover and rise by 5.6% to US$470 billion. The outlook for remittance remains as uncertain as the impact of Covid-19 on the outlook for global growth and on the measures to restrain the spread of the disease.