VN rally cools following nationwide social-distancing order

VN rally cools following nationwide social-distancing order

Vietnamese shares repealed on Tuesday as investors reacted defensively to the Government's nationwide social distancing decision to fight the COVID-19 pandemic.

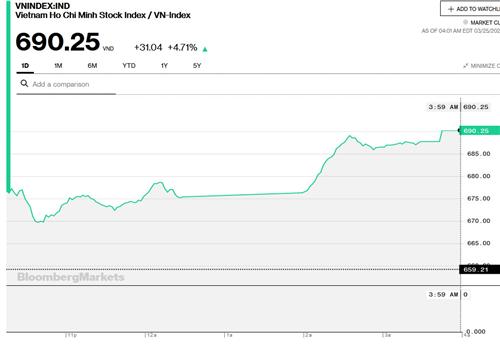

The benchmark VN-Index on the Ho Chi Minh Stock Exchange was hardly changed, inching up 0.04 per cent to end at 662.53 points.

The VN-Index was at one point up 2.47 per cent during the day after it tumbled 4.86 per cent on Monday.

The HNX-Index on the Ha Noi Stock Exchange fell 0.69 per cent to close at 92.64 points after having gained 1.82 per cent in earlier trading.

The northern market plunged 4.18 per cent on Monday. The HNX-Index has lost a total of 7.44 per cent in the last four trading days since last Thursday.

More than 314 million shares were traded on the two exchanges, worth VND4.14 trillion (US$175 million).

The local stock market was dragged down by a selloff in the afternoon session, which came after the Government decided to launch a nationwide social distancing decision, according to MS Securities Co (MBS).

The measure would force people to stop travelling and ban gatherings of more than two people to prevent the coronavirus from spreading.

The measure will take effect on 12am Wednesday, April 1 and last for 15 days.

As of Tuesday, Viet Nam had reported 207 coronavirus cases.

The selloff hit local shares and pulled them down from their intraday rallies.

Large-cap stocks narrowed their gains as the large-cap tracker VN30-Index finished down 0.37 per cent after gaining 2.53 per cent in the morning session.

Among the large-cap stocks that fell off were property firms Vingroup (VIC) and Vincom Retail (VRE), brewer Sabeco (SAB), Vietcombank (VCB), tech group FPT Corp (FPT), petrol firm Petrolimex (PLX), and SSI Securities Corp (SSI).

Meanwhile, retailer Mobile World Investment (MWG), Sacombank (STB), VPBank (VPB), Eximbank (EIB) and Coteccons Construction (CTD) were among the worst declining large-caps.

The brokerage, retail, banking, and mining and energy indices lost between 0.14 per cent and 2.66 per cent, data on vietstock.vn showed.

Foreign net selling was another burden for the market. Foreign investors on Tuesday net sold a total of VND400 billion worth of shares on the two exchanges.

The VN-Index is struggling at 650 points, and negative signals may appear if it fails to settle at that level, MBS said.