Vietnam to rely on macroprudential measures to soften Covid-19 economic shock: Fitch

Vietnam to rely on macroprudential measures to soften Covid-19 economic shock: Fitch

Fitch Solution revised its forecast for Vietnam’s credit growth to come in at 11% in 2020, from 12.50% previously.

The State Bank of Vietnam (SBV), the country’s central bank, is expected to continue leaning on macroprudential measures and targeted monetary easing to its priority sectors to cushion the economic blow from the evolving Covid-19 pandemic globally, according Fitch Solutions.

This is opposed to cuts to its key benchmark discount and refinancing interest rates, which the SBV is set to keep on hold at the current levels of 4% and 6%, respectively, over 2020, given ample liquidity in the banking sector.

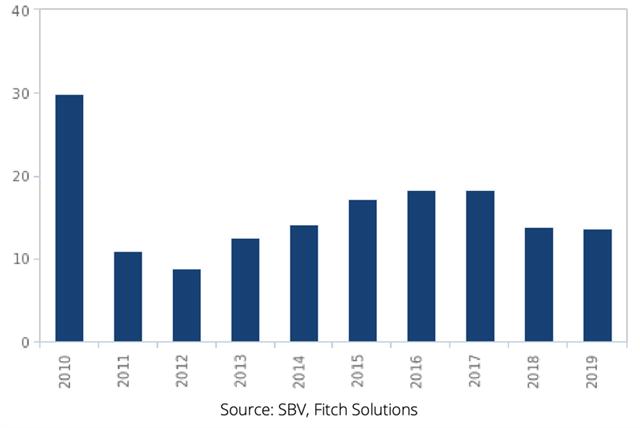

Given a weakened economic outlook due to the Covid-19 outbreak, which has caused both a supply and demand shock, Fitch Solution revised its forecast for credit growth to come in at 11% in 2020, from 12.50% previously. Such forecast reflects a weakening of credit growth from 13.65% in 2019 and also to undershoot the government’s 14% target for 2020.

Vietnam - Credit Growth, %.

|

On March 12, the SBV issued a directive encompassing several circulars outlining macroprudential measures to aid businesses coming under stress from the global Covid-19 pandemic. Measures include rescheduling of debt repayment, exemption and reduction of interest and fees, which will apply to the period between January 23, 2020 and three months after the Prime Minister announces the end of the Covid-19 epidemic.

Additionally, the National Credit Information Centre of Vietnam has also reduced prices of its credit information products and services to reduce operating costs for credit institutions and support lower interest rates.

Fitch also expected the SBV to keep its key benchmark interest rates on hold as liquidity in the banking system remains ample, following the central bank’s reduction of the interest rate on compulsory commercial bank reserves with the SBV to 0.8% per annum in December 2019, from the previous 1.2%.

Vietnam’s reserve requirement ratio remains at 3%. Excess VND reserves and compulsory foreign currency reserves yield 0% interest and excess reserves of foreign currency yield 0.05%. Hence, this rate cut would likely incentivize banks to ramp up commercial lending, given an average lending rate of 7.8%, according to IMF data, as opposed to depositing their excess funds with the SBV to grow their interest income.

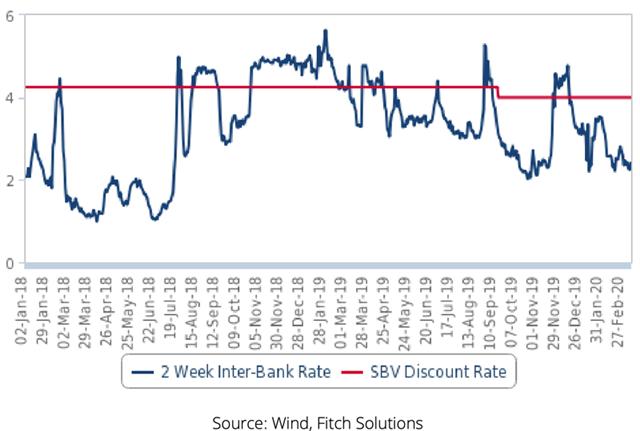

Vietnam – 2-Week Interbank Borrowing Rate & SBV Discount Rate, %.

|

Indeed, following the cut in December 2019, short-term interbank borrowing rates have fallen back below 4% (the SBV discount rate), reflecting an easing of liquidity conditions. The SBV discount rate is the rate at which commercial banks would have to pay for borrowing from the central bank when they are unable to secure loans from peers at the interbank rate.

As such, Fitch believed that the banking sector will continue to see occasional periods of liquidity stress, particularly in periods which see excess credit demand. Typically, such periods fall during the year-end peak business season when companies require money to ramp up production for the festive season as well as fulfil payment contracts and pay salaries and bonuses.

Given the ongoing global Covid-19 pandemic, such periods could come when business activity eventually normalizes, although a timeline on this is highly uncertain.

Meanwhile, the SBV could inject liquidity into the system through reserve interest rate adjustments and/or open market operations when faced with such periods of liquidity stress.