Shares may continue falling as no signs of disease control

Shares may continue falling as no signs of disease control

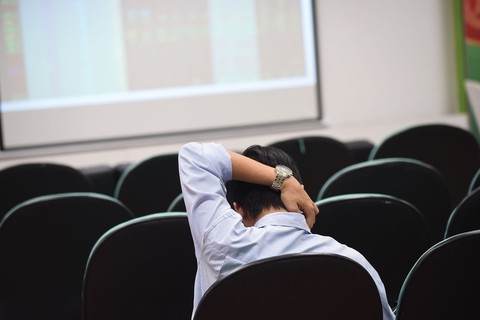

The stock market is expected to continue experiencing strong corrections, while the market bottom cannot be determined until there are clear signs of effective control over the COVID-19 epidemic, said market analysts.

The benchmark VN-Index on the Ho Chi Minh Stock Exchange fell 0.81 per cent to close Friday at 882.19 points.

The index slumped a total of 5.45 per cent last week.

An average of nearly 212.2 million shares were traded on the southern bourse each session last week, worth VND4 trillion (US$172.7 million).

“It is difficult for the VN-Index to move in a positive way during this period. The index may even decrease further,” Hoang Thach Lan, head of Personal Banking Division at Viet Dragon Securities Company, told news site tinnhanhchungkhoan.vn.

“The COVID-19 epidemic is spreading worldwide, and most importantly it has reached the US. The most considerably positive information that could help markets is the effective control over the disease. According to the sporadic information, some countries have already come up with vaccines against COVID-19, but for mass use, we probably have to wait,” Lan said.

“After a month, the COVID-19 virus has entered a new stage of spread in many countries, triggering new concerns. In Viet Nam, we now have to monitor people from not only China but also from South Korea and many other parts of the world,” said specialist Nguyen Hong Khanh at Vietnam International Securities Co (VIS).

“The anti-epidemic war is entering a crucial stage that requires the concerted efforts of the international community, not just China alone. The fight against the epidemic consumes a lot of domestic resources while making our trade exchange with the outside markets narrower,” Khanh said.

Last week, the domestic market, which is inherently very sensitive, begun to absorb the negative impact from international markets. I think that at least in the first two weeks of March, the Vietnamese stock market will still be witnessing downward trends,” Khanh said.

“Foreign investors’ strong selling activities and the COVID-19 outbreak will possibly have negative influences on global and Vietnamese economic growth,” said Bao Viet Securities Co (BVSC).

“Amid the spread of COVID-19 epidemic with no signs of control, domestic companies’ business operations and growth expectations will likely be severely affected,” BVSC said.

By the end of the first two months of this year, foreign investors were net sellers on all three exchanges with a total value of more than VND1.17 trillion.

According to BVSC, the novel coronavirus outbreak in South Korea will create more challenges for Viet Nam's economy, especially after the stall in trading activities with China.

“If the delay in trade with China has a negative impact on the demand side, the one with South Korea places more impacts on the supply side to Viet Nam's economy. Currently, Viet Nam is an important link in the global production chain of many South Korean electronics businesses, such as Samsung, accounting for nearly 30 per cent of Viet Nam's total exports,” BVSC said.

“Any interruption in the supply of raw materials will disrupt these production activities, whereby the manufacturing industry, Viet Nam's driving force for growth over the years, will be seriously affected,” BVSC said.

On the Ha Noi Stock Exchange, the HNX-Index increased 0.29 per cent to end Friday at 109.58 points.

The northern market index rose 1.38 per cent last week.

More than 60.3 million shares were traded on the northern bourse each session last week, worth VND666 billion.