German enterprises to pounce on improved conditions

German enterprises to pounce on improved conditions

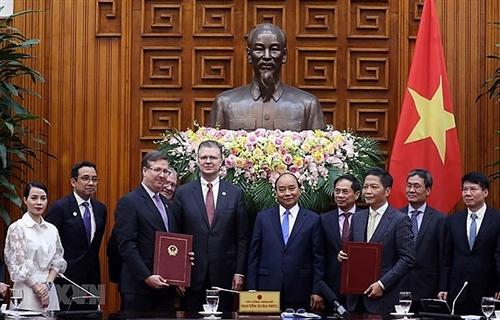

The EU-Vietnam Free Trade Agreement and the EU-Vietnam Investment Protection Agreement are expected to pave the way for EU businesses to enter the Vietnamese market. Marko Walde, chief representative of the Delegation of German Industry and Commerce in Vietnam, discussed the trend for German investors in Vietnam with VIR’s Thanh Van.

European investment is expected to flow more into Vietnam once the EU-Vietnam Free Trade Agreement (EVFTA) and the EU-Vietnam Investment Protection Agreement (EVIPA) come into force. What are the prospects for attracting German investment to Vietnam in 2020?

Marko Walde, chief representative of the Delegation of German Industry and Commerce in Vietnam

|

The EVFTA and EVIPA will bring customs facilitation and exchanging information on custom requirements, investment in the modernisation and simplification of customs procedures, and transparency in all custom requirements.

New market access opportunities across a range of sectors will be also created thanks to these agreements.

Once the agreements come into effect, European and German companies could enjoy protection of investments with trade facilitations and easier market access in the short term.

Looking ahead, we hope German investors will increase their presence in Vietnam based on the improved conditions here. I strongly believe that there will be more foreign direct investment in high-value projects in Vietnam in the long term, including from Germany.

There should be an increasing flow of investment not only directly from German small- and medium-sized enterprises, but also from companies that have been investing in China for years, and have chosen Vietnam as their next destination.

German investors would apply technology to management and training, allow more value-added production, and reduce waste of material and resources.

Could you share some potential sectors for German investors to capitalise on Vietnam’s fast-growing market?

Vietnam and Singapore have the lowest market barriers in the ASEAN, and those two countries have signed FTAs with the EU.

Based on these factors, we think that the Vietnamese market offers a lot of potential in almost all areas, especially the automobile, machinery, green energy, electronics, IT, food processing, and healthcare sectors.

With the current virus outbreak and the trend of the China Plus One strategy, do you expect a surge in manufacturing relocation to Vietnam among German companies?

We see that the epidemic is spreading further throughout China, and we are aware that it is not just the Chinese economy that is suffering from less consumption, idle factories, and broken global supply chains. Hopefully the virus will be controlled in the first quarter of 2020, paving the way for new strategies and optimal diversification for companies concerning the global supply chain.

With the Chinese policy, German companies there are looking to diversify their operations by adding another location in Asia - expanding to Vietnam, for example. This is due to the higher cost of Chinese labour and a desire for diversification, and when it comes to alternatives in the Southeast Asian region, many firms may well choose Vietnam first.

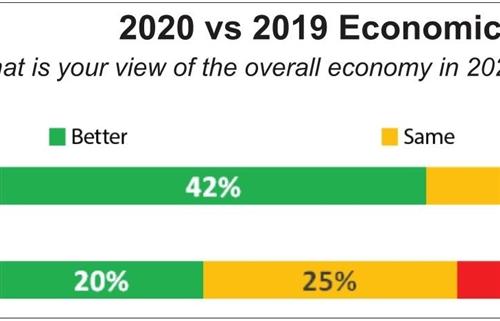

According to AHK World Business Outlook 2019, Vietnam offers the best conditions for German investors. 55 per cent of German investors in Vietnam are keen to exploit these conditions, and in 2020 they are planning to expand their activities, increase investment, and hire more staff.

What is the likelihood of German companies partaking in merger and acquisition (M&A) activities with Vietnamese businesses?

This could be a solution for German companies who intend to establish businesses or invest in Vietnam. They could enjoy the existing access to consumers, distribution channels, and partners, and represent a suitable path for equitisation, either full or partial, of state-owned enterprises in Vietnam.

But from our point of view, M&A is generally the most challenging means of entering the market. To minimise the risks, companies must conduct due diligence before entering into an agreement or financial transaction with another party.

This investigation or audit of a potential investment or product is designed to review financial records and provide an overview of any company that garners interest, the real business value of it, and the risks involved. The reliability of due diligence in Vietnam is still in doubt so there are still big risks for investors.