Vietnam banks record highest increase in brand value: Brand Finance

Vietnam banks record highest increase in brand value: Brand Finance

With five new banks included in this year’s Brand Finance Banking 500, the total number of Vietnamese banks in the global top 500 banks in brand value hits nine.

Vietnam banks recorded the highest increase in brand value, at 146%, according to Brand Finance’s latest Banking 500 report.

Source: Brand Finance Report.

|

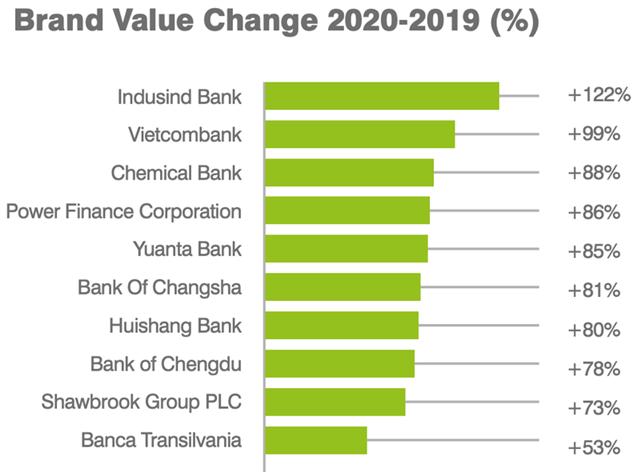

Notably, Vietcombank climbed by 99% year-on-year in 2020 to US$0.8 billion in brand value, the second highest growth rate by percentage globally.

Since the Vietnamese government introduced its strategy to boost accountability and strength of the banking sector, including more stringent capital requirements and greater transparency, customer perception has improved, stated the report.

“Growing confidence in the sector – reputation measures have improved 8% in Brand Finance’s research – has translated into higher revenues and a more positive outlook from equity analysts,” added Brand Finance.

In 2019, there were only four Vietnamese banks, namely Vietcombank, BIDV, VietinBank and VPBank in the list, this year’s ranking included another five banks in Agribank, Techcombank, MB Bank, ACB and Sacombank, taking the number of Vietnamese bank in the global top 500 banks in brand value to nine.

Compared to last year’s report, Vietcombank’s ranking improved from 325th to 207th, BIDV from 307th to 276th, VPBank from 361st to 280th, while only VietinBank moved down from 242nd to 277th.

The rankings of the five new banks in this year list was 190th, 327th, 386th, 420th, and 422nd, respectively.

For the first time since 2009, the total brand value of the world’s 500 largest banks has declined year on year – from US$1.36 trillion in 2019 to US$1.33 trillion this year.

China’s ICBC retained its top spot as the world’s most valuable banking brand, breaking the US$80 billion mark. Chinese banks continue to occupy the top four of the Brand Finance Banking 500 2020 ranking.

Meanwhile, five US banks are in the top 10, although overall, the US banking sector declined by 5% in brand value. Wells Fargo is the top bank and JP Morgan has grown by 15% to enter the top 10.

European banks declines by 7%, more than any other region, with several major banks seeing significant drops in brand value.