HSBC considers cutting thousands of jobs and downsizing its businesses

HSBC considers cutting thousands of jobs and downsizing its businesses

HSBC Holdings Plc, the parent firm of HSBC Vietnam, is weighing whether to cut thousands of jobs, a sign that it may accelerate the downsizing of its global businesses and reshuffle senior executive ranks as the UK-based lender searches for growth and ways to lift sagging returns.

HSBC's overhaul plans will be revealed today (February 18, 2020), when it reports the results for 2019.

|

Details on the manner of the exits, the scale of the write-downs, the impact on earnings, and the jobs at risk have so far been sparse.

According to Bloomberg, people familiar with the matter say the measures announced today will likely include billion-dollar write-downs, cuts at trading desks, and a reduction in exposure to countries ranging from Turkey and Greece to Oman. Efforts to sell HSBC’s French retail business are progressing, and an overhaul of the underperforming US business is underway.

"It is a pivotal moment for HSBC," a London-based executive at a fund management company which owns HSBC shares told Nikkei Asia. "After years of restructuring and billions in costs, the bank has little to show in results, and the board realises investor patience is wearing thin. I believe serious effort has been put in place for a big-bang overhaul."

It would be the UK-headquartered lender’s third major overhaul in a decade.

The first attempt began a decade ago after a $1.9 billion fine resulting from a money-laundering scandal.

The second enormous reshuffle was in 2015 since the bank took a heavy toll on its Europe and US operations.

Confidence has plummeted amongst HSBC's 237,000 staff as the lender prepares for a strategy review later this month that is expected to cull hundreds of jobs.

Only four in every 10 employees in Europe – which excludes the UK business – said they felt confident about the bank's future, a report conducted by Bloomberg revealed.

While the bank counts on Asia for more than 95 per cent of its profit, about 45 per cent of its capital still backs assets deployed in the US, Europe, and the UK.

Asia accounts for just over 40 per cent of the risk-weighted assets.

Oddly enough, though, HSBC’s biggest market – Hong Kong – is also suffering through serial crises: anti-government protests in the former British colony, followed by coronavirus on the Chinese mainland.

Then there are the record low interest rates in many countries, which are hampering lenders around the globe, Bloomberg reported.

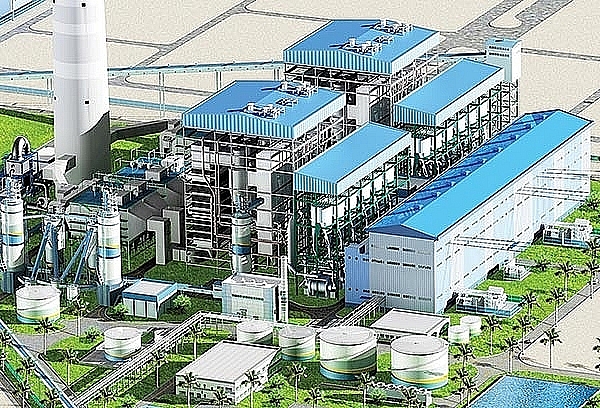

As VIR previously reported, HSBC last month officially pulled out of Vinh Tan 3 thermal power plant – a major coal project located in Binh Thuan province, Vietnam.

|

HSBC’s cancellation marks the latest move by a major international lender to ease off on bankrolling fossil fuel in Asia.

The announcement was made in response to an opinion editorial headlined “HSBC lags as finance cleans up on Asian energy”, written for Asia Times by Munira Chowdhury, an analyst for Australia-based finance pressure group Market Forces.

The story was updated, with the footnote from Asia Times stating that HSBC had told the publication that it has “no involvement at all in the Vinh Tan 3 project – including as financial adviser, funding arranger or prospective lender.”

Back in 2017, it was rumoured that insufficient control was the main reason that saw HSBC offload its shares in Techcombank. While HSBC shareholders expected to receive dividends, Techcombank did not pay any dividends for six consecutive years since 2010 in a bid to further raise charter capital.

As of now, it is still not clear whether HSBC Vietnam will be affected by job cuts.

VIR will be posting updates as new information is released.