Debt maturity in 2020 – 2021 to put pressure on Vietnam’s state budget

Debt maturity in 2020 – 2021 to put pressure on Vietnam’s state budget

Vietnam is capable of repaying debts, as the annual debt repayment accounts for 15 – 16% of total state budget, below the ceiling limit and international practice of 25%.

Debt maturity in the 2020 – 2021 period would put pressure on Vietnam’s state budget, but still remain under control, according to KB Securities Vietnam (KBSV).

Data from the Ministry of Finance (MoF) revealed 10.3% of domestic debts will come due between 2020 and 2021, of which the majority were government bond with five-year maturity and issued in 2015 – 2016.

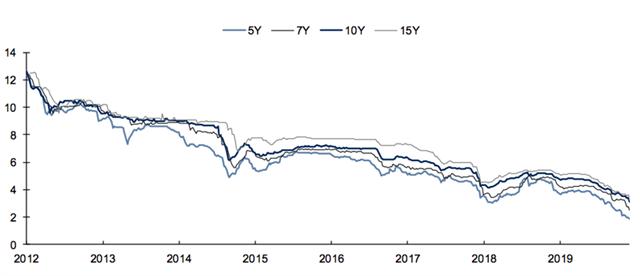

Government bond yields. Source: MoF.

|

Since 2017, the maturities of government bonds have been extended and allocated flexibly, ranging from 15, 20 to 30 years.

However, KBSV expected Vietnam to be more than capable of repaying such debt, as the annual debt repayment accounts for 15 – 16% of total state budget revenue, below the ceiling limit and international practice of 25%.

Moody’s decision to change Vietnam’s rating outlook to negative was related to government-guaranteed debt, while the MoF attributed the issue to a lack of consistency in administrative coordination among government agencies in fulfilling Vietnamese government’s contigent liabilities, not because of its financial capacity.

KBSV said Vietnam’s adoption of new GDP calculation method since 2020 would reduce the ratio of public debt to GDP, creating more room for bond issuances and allowing the government to restructure debt.

The current low interest rates also help relieve pressure of repayment for the government, as long-term interest rates are at all-time low.

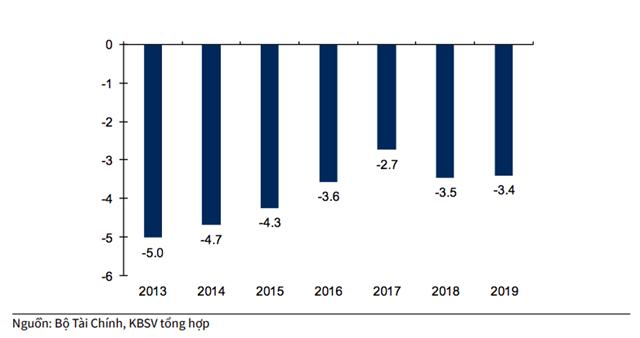

Vietnam's fiscal deficit over the years.

|

In 2019, the country's fiscal deficit continued the declining trend to 3.4% of the GDP. Meanwhile, revenue from tax collection increased 4% year-on-year. Of the total, revenue from value-added and corporate taxes jumped 10% thanks to greater efficiency in tax management, while income tax increased by 20% thanks to tax base expansion.

In contrast to increasing state budget revenue, the country’s budget spending remained unchanged compared to last year. KBSV said tightening procedures in public disbursement restricted government’s spending last year.

Vietnam's ratio of public debt to GDP.

|

According to KBSV, fiscal deficit at a much lower rate than GDP growth reduced the ratio of public debt to GDP to 56.1%, the lowest rate in the last six years.

KBSV expected disbursement rate of public investments to sharply increase in 2020, mainly thanks to the approval of the Law on Public Investment to address shortcomings, implementation of projects of national priority in 2020, including the North-South expressway and Long Thanh International Airport, and greater efficiency in tax management.

Recently, Vietnam’s taxation authority fined Coca-Cola Vietnam and Heineken for VND821 billion (US$35.39 million) and VND917 billion (US$39.53 million) in tax arrears.