Overseas investments by Vietnam SOEs suffer increasing losses

Overseas investments by Vietnam SOEs suffer increasing losses

Overseas investment projects of Vietnamese state-owned enterprises made losses of $367 million in 2018, up 265 percent year-on-year, a government report said.

As of the end of 2018, Vietnam had 19 wholly state-owned enterprises or enterprises wherein the state held at least a 50 percent stake investing in 114 projects abroad, according to the report which was submitted to the National Assembly this week.

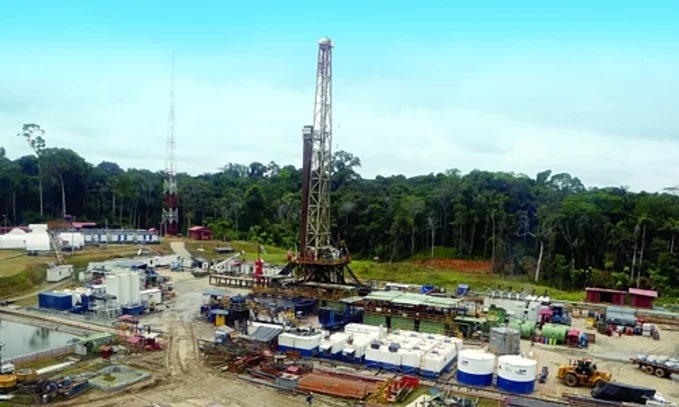

Most of the projects are in the fields of telecommunications, oil and gas exploration and exploitation, rubber plantation, mining, banking and finance.

Of the 114 projects, 84 were profitable, with a combined profit of $187 million, a 24 percent decrease compared to 2017. The remaining projects however reported significantly losses of $367 million, a 265 percent increase against 2017.

Most of the losses came from investments made by military-owned telecom giant Viettel and the Vietnam Rubber Group (VRG), which accounted for losses of $349 million and $7.7 million respectively.

In its report, the government said that over 60 percent of investments in the fields of telecommunications, petroleum businesses and services, construction and accommodation services generated profits.

Mining and oil and gas exploration and exploitation were the fields with the lowest percentage of profitable projects at 11 and 17 percent respectively.

Telecommunications, rubber plantation and mining were also highlighted as fields with large numbers of projects with accumulating losses.

In general, both revenue growth and profit saw decreases across most fields in 2018 compared to 2017. The most significant revenue falls were in mining (27 percent) and petroleum businesses (23 percent) mostly due to fluctuations in global oil prices.

The largest profit fall was in telecommunications, at $349 million, mainly because of currency devaluation and inflation in the invested countries in Africa, South America and Southeast Asia, as well as tough competition.

Investments in rubber plantation and processing also saw a 40 percent decrease in profit due to a sharp decline in the price of natural rubber and changes to land and investment policies in the invested countries, namely Laos and Cambodia.

The government also assessed that a common reason behind the outward investments' underperformance was Vietnam's limited ability in market forecasting, management capability, financial capacity and experience in making overseas investments.

A Viettel leader told VnExpress that the company was having difficulties due to fluctuations in currency exchange rates, particularly in the African market.

Similar to other companies that make investments abroad, Viettel usually pays a small amount of charter capital and the remaining fund is invested by lending to foreign partners or joint ventures.

The Viettel official therefore argued that the company's losses were only due to the revenue and profit being converted to U.S. dollar, and that its outward investments were profitable and performing well when evaluated in local currencies.

Furthermore, some of the company's telecom projects were still in the investment phase or have just been put into operation so they still need to recoup large investments.

According to the report, the total registered investment of overseas projects was approximately $12 billion by the end of 2018. The three largest investors are oil giant PetroVietnam ($6.7 billion), Viettel ($3 billion) and VRG ($1.4 billion).