Foreign buying of G-bonds reaches $1 billion

Foreign buying of G-bonds reaches $1 billion

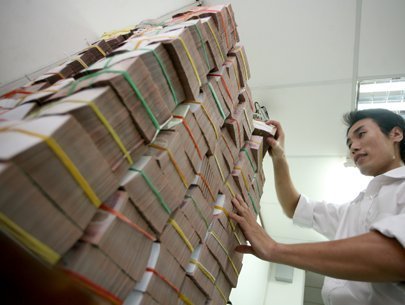

Foreign investors bought government bonds worth some US$1 billion from the local market, the Ha Noi Stock Exchange (HNX) said.

Nguyen Thi Hoang Lan, HNX's deputy chairman, said this year, long term bonds of 10 years, 20 years and 30 years had sold better. In addition, the portion of buyers of G-bonds had changed. Previously, commercial banks often accounted for 80 per cent of bond buyers, this year, however, the rate fell to 60 per cent.

The buying rate of insurance companies, investment funds and foreign investors was some 1.18 per cent in 2011, which rose to 8.42 per cent in 2015. This year, with more purchases from insurers such as Prudential and AIA, the rate was some 20 per cent.

According to statistics, the average transaction value in the bond market reached VND5.66 trillion per auction, an increase of over 1.5 times compared with 2015. The value traded on the bond market also accounted for over 65 per cent of the local stock market of bond and stock.

Lan also said the excitement and superior liquidity on the secondary market clearly contributed to the increase in the primary market of G-bonds. However, she said the $1 billion foreign investment in G-bonds still only accounted for some 5 per cent of the total G-bond market in Viet Nam, adding that to reach integration with the ASEAN capital market, Viet Nam should gradually raise the standards of the bond market to attract more foreign investment.

Viet Nam's state treasury offloaded all VND1 trillion (US$44.7 million) 10-year government bonds offered on September 21 at the coupon rate of 6.5 per cent per annum, 0.44 per cent lower than the previous session on June 22.

A week ago, it also offloaded VND3.5 trillion on the HNX.

In particular, the exchange said the treasury sold VND710 billion of the total VND1.5 trillion 20-year bonds at a coupon rate of 7.73 per cent per annum, 0.02 per cent lower than the previous session on June 29.

On the same day, the treasury also sold VND780 billion of the entire VND1.5 trillion 30-year bonds offered at a coupon rate of 7.98 per cent per annum, 0.02 per cent lower than the previous session on August 31.

Meanwhile, all the 15-year bonds, worth VND2 trillion, were sold at a coupon rate of 7.47 per cent per annum, 0.18 per cent higher than the last session on August 17.

Up till September 21, the treasury had mobilised more than VND250.3 trillion, exceeding its target of the whole year's plan for bonds, which was already increased from VND220 trillion to VND250 trillion in June.