Public corporate bond offerings expected to rebound rapidly in H2 2025

Public corporate bond offerings expected to rebound rapidly in H2 2025

Corporate bonds — especially those issued via public offerings — are expected to regain momentum in the second half of 2025, buoyed by a mix of policy support and rising market demand.

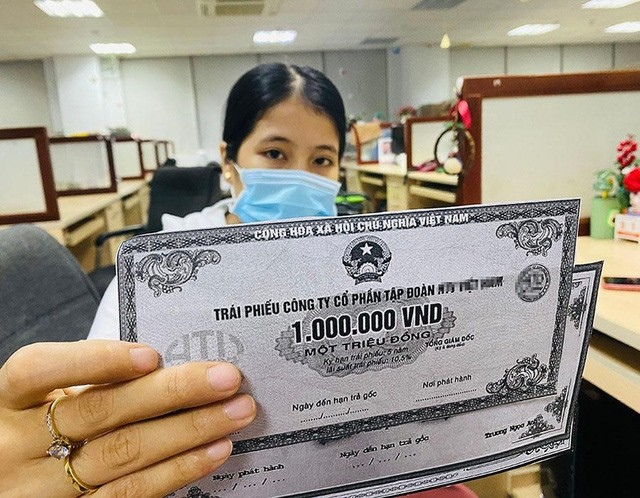

Public corporate bond offerings expected to rebound in H2/2025. — Photo vietnamplus.vn |

As Việt Nam’s financial markets continue a deeper phase of adjustment following a turbulent period, capital-raising channels are showing increasingly clear signs of divergence.

Among them, corporate bonds — especially those issued via public offerings — are expected to regain momentum in the second half of 2025, buoyed by a mix of policy support and rising market demand.

According to data from FiinRatings and FiinGroup, Việt Nam’s corporate bond market maintained robust growth in the first half of 2025, with total issuance reaching VNĐ248.6 trillion (US$9.5 billion), up 71.2 per cent year-on-year. June alone witnessed an impressive breakthrough, with VNĐ105.5 trillion issued — the highest monthly figure since the beginning of the year.

However, the entire volume was from private placements, with public issuances still largely absent. That said, public offerings accounted for 11.2 per cent of total issuance in the first half — up 62.3 per cent from a year earlier — signalling a budding recovery trend.

The dominance of private placements stems largely from the strong activity of credit institutions, which accounted for over 83 per cent of total issuance in June and 76 per cent across the first six months.

This reflects the liquidity-balancing needs of banks amid credit growth of 8.3 per cent, while deposit mobilisation rose only 6.1 per cent. Meanwhile, non-financial corporates — particularly in the real estate sector — also showed signs of revival, with issuance value up 17.1 per cent year-on-year.

Average bond yields remained relatively stable, at around 5.5 per cent for credit institutions and close to 10 per cent for non-bank enterprises. This yield level is considered attractive to investors, especially as other asset classes such as equities and property remain subject to volatility and uncertainty.

On the secondary market, liquidity continued to improve, with total transaction value in the first half exceeding VNĐ651 trillion, a 13.2 per cent rise year-on-year. Notably, real estate bonds saw a 37.6 per cent surge in liquidity, reflecting investor optimism about the sector’s gradual recovery as many firms work to restructure and settle overdue obligations.

Although redemption pressure in the second half remains significant — estimated at around VNĐ125 trillion, with real estate accounting for 53 per cent — experts believe the market is unlikely to repeat the chaos seen in 2022–2023. This is thanks in part to legal reforms and ongoing corporate restructuring efforts, particularly among property developers, which are beginning to yield results.

Significantly, new regulations that cap debt-to-equity ratios at no more than five times (as assessed by FiinRatings) are not expected to severely impact supply, as most current issuers already comply with the requirement. Instead, the rules are seen as a positive filtering mechanism that will enhance bond quality and reduce the prevalence of undercapitalised issuers or shell companies set up purely for bond issuance.

Experts argue that this is an opportune time for public bond offerings to regain traction. Tightened scrutiny of issuer quality is creating favourable conditions for financially sound and transparent enterprises to access a broader base of retail investors, rather than relying solely on private placements.

In addition, the recent Decision 21/2025/QĐ-TTg on the Green Classification List is expected to fuel a wave of sustainable investment, particularly in the green bond segment. This move will likely stimulate both supply and demand for public bond offerings in the months ahead.

- 08:39 17/07/2025