Shares up on Govt's exit from big firms

Shares up on Govt's exit from big firms

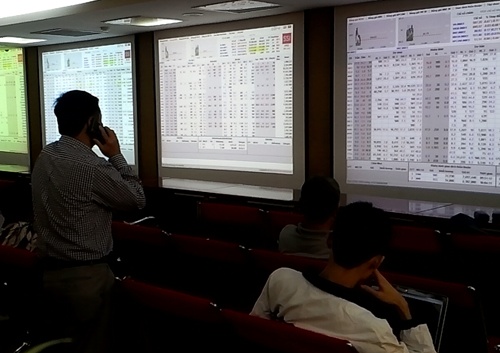

Shares advanced yesterday on the two national stock exchanges, buoyed by investor expectations of a specific roadmap for the Government to sell its capital proportions in many big listed companies.

On the HCM Stock Exchange, the VN-Index increased 0.4 per cent to 660.5 points. It was down 0.2 per cent on Tuesday.

On the smaller exchange in Ha Noi, the HNX-Index also added 0.4 per cent to close yesterday at 83.8 points.

The Government and ministries yesterday had a meeting to discuss the plan of divesting State capital in 10 enterprises in which the State Capital Investment Corporation (SCIC) is representing and operating.

In May 2015, the Government requested SCIC draw a roadmap for selling State holdings in 10 big enterprises, of which eight businesses are listing shares on the two national exchanges with a combined market capitalisation of around US$4.5 billion.

Six of these eight companies gained value yesterday after the information. Shares in Binh Minh Plastic (BMP) and Tien Phong Plastic (NTP) were the biggest gainers, with each rising 7 per cent.

Others including dairy firm Vinamilk (VNM), software producer FPT Corp (FPT), Vietnam National Reinsurance (VNR) and Bao Minh Insurance (BMI) each increasing between 1.2 per cent and 6.5 per cent.

Only Sa Giang Import Export (SGC) declined 9.4 per cent and Ha Giang Mineral and Mechinics (HGM) closed unchanged.

"This is an investment for all investors," said Nguyen Minh Ngoc, director of the Corporate Finance Department at Bao Viet Securities Co.

Ngoc hailed the Government's policy of selling its holdings in the companies in which the State does not need to hold major stakes. This loosened State control on the companies and made them more appealing to investors.

Viet Nam's stock market has rallied 13 per cent this year amid optimism the Government will ease regulations for foreign investment. Last month, the market watchdog State Securities Commission allowed Vinamilk to remove the 49-per-cent foreign ownership cap on its stocks, spurring speculation that more companies will follow.

Foreign investors purchased shares worth a total net value of $35 million on the local stock market in the first seven months of this year, supporting the market uptrend since the beginning of the year, data of the National Financial Supervisory Commission showed.

Liquidity decreased slightly from the previous session, totaling 166 million shares worth a total value of VND3.33 trillion, down 18.2 per cent in volume and 14.6 per cent in value from Wednesday's figures.