Earnings per share to grow by 10.5%

Earnings per share to grow by 10.5%

VN-Index has increased by 15.1% from the beginning of the year till July 7, 2016. Earnings per share (EPS) on HSX shall rise by 11.3% and the VN-Index shall be traded at P/E of 13.5x, which is currently 14.9x (as of July 7, 2016).

Cyclical industries such as real estate, financial services and technology are expected to be top performers, whereas commodity-based stocks will record low earnings. These are the key findings of FiinPro Talk #1 held by StoxPlus on July 8, 2016, in HCM City.

Our database for calculation and analysis was extracted from the financial data of listed and public companies on FiinPro Platform, StoxPlus. The forecasted EPS was based on net income by management estimates, mostly from the annual general meeting of shareholders (AGMs), analyst forecasts from sell-side reports and our own forecasts.

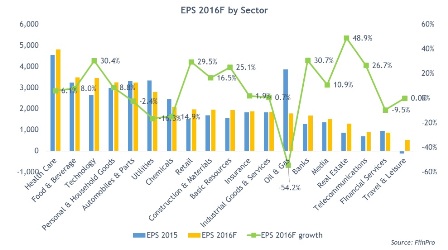

In fact, Viet Nam is still considered a frontier market, and international investors mainly bet on the growth potential of Vietnamese enterprises, particularly the growth potential of earnings per share or EPS. Based on our comprehensive data source of FiinPro Platform, it is estimated by StoxPlus that EPS 2016 on HSX and HNX shall increase to touch VND2,028, up by 10.5% compared with 2015.

Cyclical industries with a high growth rate of EPS 2016 consist of real estate (up by 48.9%), banks (up by 30.7%), and technology (up by 30.4%). Meanwhile, oil and gas and chemicals are predicted to have negative EPS.

Among the three exchanges UPCoM, HSX, and HNX, companies on UPCoM are expected to increase its earnings by 206.3% in 2016. Not only attracting investors by EPS, UPCoM also has active trading activities after SOEs divesture. These two factors imply that UPCoM is very attractive with a lot of potential investment opportunities in 2016.

P/E 2016 on HSX and HNX are expected to reach 13x

Regarding sector level 2, three industries with the lowest P/E 2016 are automobiles and parts (7.1x), technology (7.4x) and retail (9.2x). These may be optimal choices for investors with low risk tolerance, who prefer high dividend and low P/E.