VN-Index may continue climb in Q2

VN-Index may continue climb in Q2

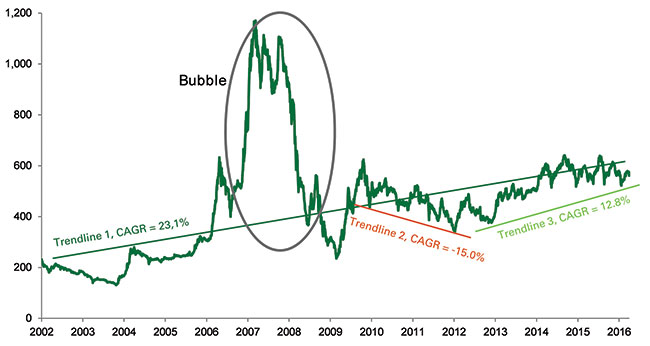

The VN-Index continues to move below the long-term growth trend (trend-line 1) and extend the medium-term trend (trend-line 3) which started in 2012, with the compound annual growth rate (CAGR) for the whole period at 12.8 per cent (as shown in the graph). To assess the market outlook of the VN-Index in the second quarter of 2016, we should start at its fundamental value.

According to our latest updates, the total 12-month trailing net income of listed companies on the HSX at the end of March had risen by just 5.2 per cent year-on-year (y-o-y), much lower than the rate of 25.4 per cent recorded in 2015’s fourth quarter. This was due to the unexpected decline in the growth rate of the industrial and utilities sectors, which had been crucial to the growth of the VN-Index. Energy companies’ business results were also negatively affected by the poor performance of crude oil prices. The 12-month trailing earnings per share (EPS) growth of listed companies on the HSX was only 3.7 per cent y-o-y, slightly more than half of the seven per cent recorded in 2015’s fourth quarter. These figures were in line with the rather slow GDP growth of 5.46 per cent in 2016’s first quarter, which was much lower than the 6.12 per cent rate recorded in the same period last year.

The VN-Index is still trading with a price-to-earnings (P/E) ratio of 12, making it much cheaper than regional markets. Government bond interest rates are also expected to stay rather flat in 2016’s second quarter, and thus we expect the VN-Index to move around the same P/E level in the coming quarter. Assuming the trailing 12M EPS for listed companies in the second quarter will be around the first quarter median of 3.7 per cent, the VN-Index should rise to around 592-595 by the end of 2016’s second quarter.

Apart from fundamental value, the following factors could impact market performance in 2016’s second quarter via supply-demand and market sentiment:

- Crude oil prices

- The possibility of a Fed interest rate hike

- Ministry of Finance Circular 7

As mentioned above, the VN-Index was significantly influenced by crude oil prices through the price movement of oil and gas stocks in 2016’s first quarter. We expect this correlation between oil and gas stocks and crude prices to persist in the second quarter, and higher oil prices should support oil and gas stocks further. Despite the failure of the Doha meeting to reach an agreement, crude prices still managed to move upward due to temporary supply disruptions in Kuwait, Nigeria, and Venezuela. Furthermore, we have seen more positive signals from supply-demand factors. From the supply side, US output has fallen further, as shown by a drop in the number of oil rigs and a fall in crude inventories. Meanwhile, demand has started to show signs of picking up as the peak season for gas consumption draws nearer, bringing with it an expectation of a more “balanced” oil market.

A cautious approach from the Fed with regards to changes in monetary policies, as shown in the Federal Open Market Committee meeting last March, has eased concerns over a rate hike in the short term, which should have a positive impact on indirect foreign investment in emerging markets. According to data from Bloomberg, foreign outflows from regional markets seem to have ended, as shown by the net bought value at key stock exchanges in the first quarter, such as those in Thailand, Indonesia, and the Philippines. As such, we expect foreign investors to return to Vietnam in the second quarter, even though their net buying might not be significant. Continuous net buying by foreign investors in April played an important role in pushing the VN-Index to above 580.

Lastly, Circular 7 from the Ministry of Finance took effect on March 15, 2016. This document will affect the investment and lending activities of securities firms. Under the new regulations, margin lending via three-party contracts will now be prohibited, and many investors are worried that this will affect margin flows to the stock market. However, in the opinion of VPBS, Circular 7’s impact on the stock market will be negligible as three-party contracts only account for 20 per cent of the total margin in the market, and a number of current three-party contracts will be re-created in other forms once they are cleared, instead of being withdrawn from the market completely.

With such positive factors, we expect the VN-Index to maintain its upturn after the holiday ends, heading to 610-615 by the middle of the second quarter, before closing the quarter at 595, fully reflecting market fundamentals.

vir