FDI survey may lead to new property regulations

FDI survey may lead to new property regulations

Cambodia’s property sector continues to grow, offering both opportunities and challenges for both foreign and local investors. Meanwhile, ahead of the ASEAN Integration, a wider access to transparent information about the FDI fuelling the sector could lead to the adoption of stronger regulatory principles and standardized practices that could benefit the industry and attract more investment, experts said.

Therefore, last week, the National Bank of Cambodia (NBC) announced that it would launch a detailed survey—set to be completed by the end of September—of foreign investors operating in the Kingdom to understand the benefits investment brings to the local economy and promote informed policy making decisions. Many see this measure as potentially paving the way to encourage more investment.

“When it comes to FDI for property, it is not only about just bringing in investors, but working with investors as well. It is a step in the right direction to encourage further investment,” said Kevin Goos, CEO of Century 21 Cambodia. “Transparent transactions are naturally good for the people, workforce and investors,” he said, adding that it could also lead to the adoption of the long awaited construction code.

Yet, Saraboth Ea, managing director of MAXEM Property, explained that from a property development perspective, due to the nature of market forces, a lot of factors are already in place to encourage foreign investors to operate in Cambodia, such as the loose regulatory environment and the demographic growth prospects of the population.

“As most people can see by the number of development projects here in Phnom Penh, there isn’t a dearth of companies who want to invest here,” he said, explaining that the data on foreign investment is not the primary concern.

“In many cases, property developers actually will disclose their aggregate investment capital in the project because they know that knowledgeable investors would be able to figure this out anyway,” he said.

“I don’t think the issue has so much to do with transparency within the sector in terms of the financial motivations behind a project or determining the investment cost of a particular project,” he said, adding that for investors it is fairly easy to ascertain the estimated market value of a project by looking at the price of construction supplies, land prices and labour costs.

But, he added, that the harder challenge for transparency in the property development market resides in the data available of a developer’s financial situation, business background and project funding.

“This is far more relevant to the investor as these can help them to determine the inherent risk behind a project. Getting this type of information is much harder to obtain and often murkier in terms of reliability, especially from local developers. Ideally, the government should be able to obtain industry data for all developers, not just foreign developers,” he said.

While the lack of detailed data and transparency in regards to FDI has often been an obstacle for the government to adopt effective policies, which in turn has made businesses apprehensive to enter into the Kingdom’s market, when it comes to property, the real boon of this survey is if it actually leads to policy reform.

“If the survey can help shed light for the government policy makers to come up with better initiatives and regulations that will improve the industry, and can provide buyers with the right information to make informed investment choices, then it is a good start,” said Saraboth.

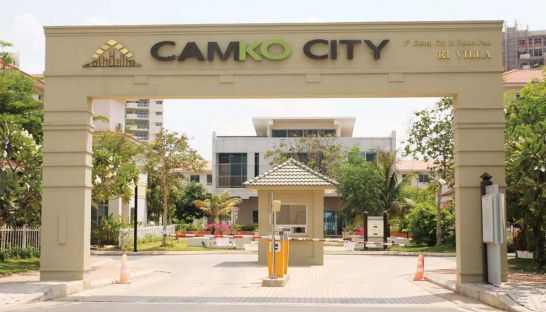

Steven Higgins, founder and managing partner of Cambodia-based investment firm Mekong Strategic Partners, does not believe that failed or delayed projects like Camko City and Gold Tower 42 could have been averted had the FDI reporting been more transparent.

“The projects were either ill-conceived, and or the backers of the projects had their own problems in their home country, so it’s not really about the quality of FDI reporting,” he said.

“FDI isn’t really different from local investment in terms of transparency - the public doesn’t necessarily find out a lot about either. What is different is that local investors are more likely to understand the market, and to understand the risks. You wouldn’t get a local investor trying something like Camko City,” he added.Echoing the statement that the difference between local investment and FDI in property is treated equally, but still unattainable by the public, Saraboth said that the real question is if this survey can provide useful information for both buyers and investors.

“If it can bring transparency to better understanding the risks behind the development project, then it will help to weed out those developers who are not willing to be fully upfront about their capabilities or financial position to see the project through to completion,” he said.

In order to prevent projects from failing or being delayed by financial constraints, better regulatory practices and financial safeguards need to put in place.

“Yet this is often difficult in a country like Cambodia that is trying to remain open, attractive and profitable at the same time,” Saraboth explained.

“An example would be to have a minimum capital reserve held as guarantee until the project reaches a certain milestone in a similar way that a performance bond works. This had been proposed before and some form of this regulation should seriously be looked at,” he said, adding that this could potentially deter investors and that level of capital reserves would “need to be fair.”

“It’s a delicate balance for the government of a developing country to have enough safeguards in place to protect buyers while still making the climate attractive enough for developers, both local and foreign, to enter the market,” he said.